What Are Forex Lot Sizes & How to Calculate Them?

When you first get into forex trading, one of the first terms you’ll come across is “lot.” So what is a lot in forex, and why should you care? This guide breaks it down in simple terms. A lot is basically the number of currency units you’re trading, but there’s more to it than that. It plays a big role in how large your trade is, how much you’re risking, and how much you could gain or lose. We’ll go over the different lot sizes and how each one can impact your trading decisions and results.

We’ll also walk you through how to figure out lot sizes the right way and show you how helpful tools like lot size calculators can be. They’re not just there to do the math for you; they’re key to managing your risk, keeping your money safe, and making more thoughtful, disciplined trading moves.

What is Lot Size in Forex?

In forex trading, a “lot” refers to a standardized unit that defines how much currency is being bought or sold in a given trade. Instead of dealing with random amounts, traders use these lot sizes to maintain uniformity and streamline transactions. It’s a system that brings clarity and structure to the otherwise fast-moving and often volatile world of currency exchange.

Lot size isn’t just a technical detail; it directly shapes the size of your position, how much you stand to gain or lose, and how much risk you’re really taking on. The bigger the lot, the more each tiny price move matters. For instance, a 1-pip shift in the EUR/USD pair can mean something very different if you’re trading a micro lot versus a standard lot. That’s why knowing how to select and calculate the right lot size isn’t optional, it’s a core part of making sure your trades match your strategy, account balance, and comfort with risk.

Whether you’re working with a modest account and trading micro lots, or handling bigger positions with standard lots, picking the right lot size is crucial. It’s not just about fitting your strategy it’s about protecting your capital and setting yourself up for sustainable, long-term gains.

Learn what pips are and how they work.

What are the Types of Forex Lot Sizes?

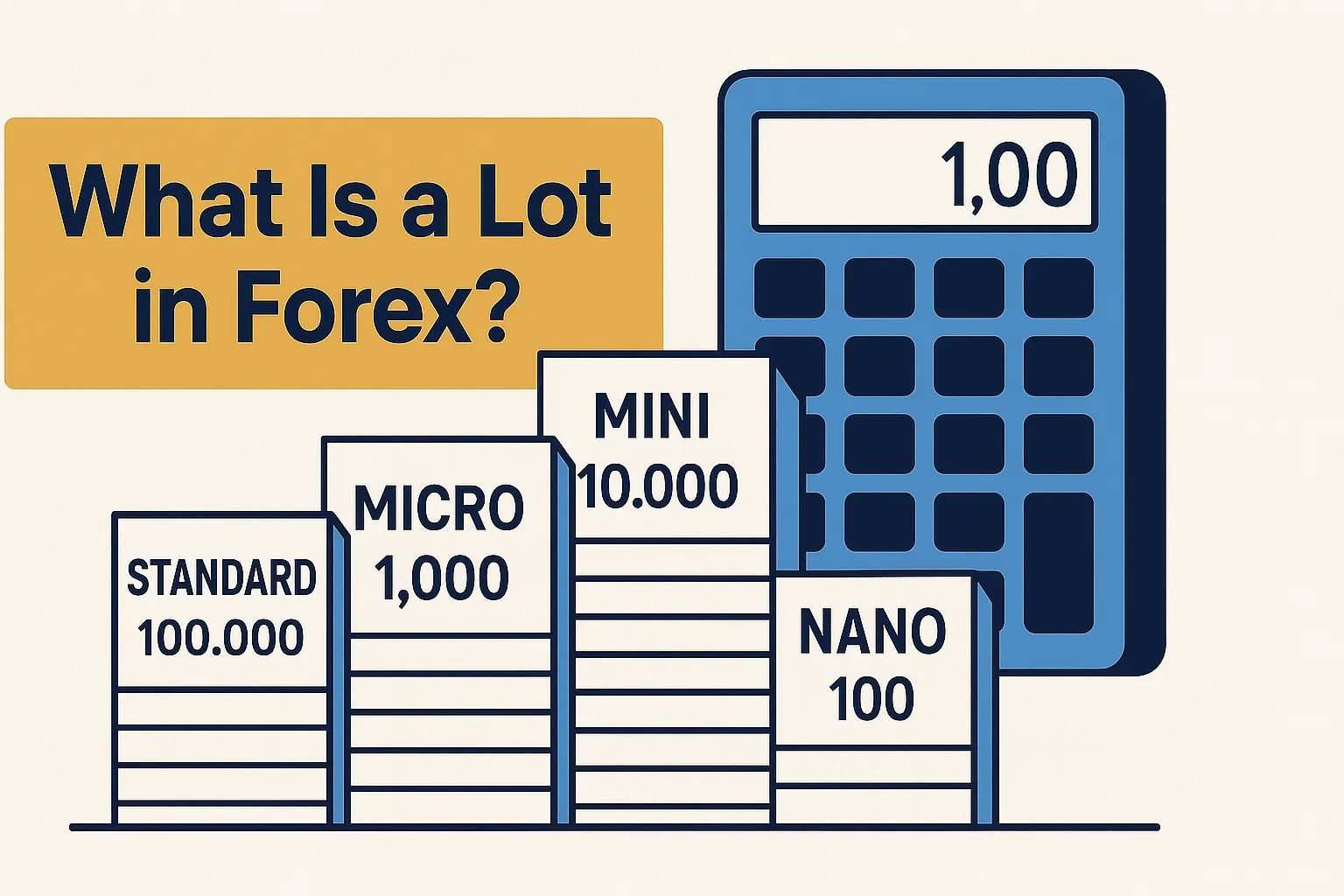

Forex offers a range of lot sizes to suit different trading styles, account sizes, and risk tolerances. The most commonly used lot sizes include:

| Lot Type | Units |

| Standard | 100,000 |

| Mini | 10,000 |

| Micro | 1,000 |

| Nano | 100 |

1. Standard Lot (100,000 units)

A standard lot is the largest commonly traded lot size in forex, representing 100,000 units of the base currency in a currency pair.

- Who uses it? Due to its large scale and high exposure, standard lots are typically used by experienced traders and institutions with significant capital.

- Example: In a EUR/USD trade, one standard lot equals 100,000 euros. Each pip movement in a standard lot generally equates to $10 in profit or loss, depending on the currency pair and market conditions.

2. Mini Lot (10,000 units)

A mini lot equals 10,000 units of the base currency, essentially one-tenth the size of a standard lot. With each pip typically valued at around $1, mini lots strike a nice middle ground for traders. They offer a chance to get real market experience and understand how price movements affect your trades, all without taking on the higher risk that comes with standard lots. For many, it’s a smart balance between accessibility and meaningful profit potential.

- Who uses it? The Mini lot is ideal for beginner traders, those with moderate capital, or anyone looking to limit their risk exposure while still participating meaningfully in the forex market.

- Example: If EUR/USD is trading at 1.2000, buying one mini lot means you’re purchasing 10,000 EUR, and a 10-pip move would result in a $10 profit or loss.

3. Micro Lot (1,000 units)

A micro lot is made up of 1,000 units of the base currency, just a tenth the size of a mini lot and one-hundredth of a standard lot. With each pip movement typically worth around 10 cents, micro lots are perfect for learning the ropes without putting much money on the line. They let you practice, fine-tune your strategy, and get comfortable with lot size calculations, all while keeping risk at a minimum. It’s a safe, sensible starting point for new traders easing into the forex market.

- Who uses it? The Micro lot is ideal for beginner traders or those with small account balances who want to take smaller, lower-risk positions while gaining experience in the forex market.

- Example: If EUR/USD is trading at 1.2000, buying one micro lot means controlling 1,000 EUR, and a 10-pip movement would result in a $1 profit or loss.

4. Nano Lot (100 units)

A nano lot is the smallest trade size you’ll find in forex, just 100 units of the base currency. That’s one-tenth of a micro lot and a mere one-thousandth of a standard lot. Each pip movement is usually worth about one cent, which makes nano lots ideal for testing out new strategies, getting a feel for live market conditions, or simply trading with very low risk. It’s a great option for beginners or cautious traders who want to learn without putting too much on the line.

- Who uses it? The nano lot is not commonly used in standard forex trading; nano lots are offered by some brokers specifically for ultra-low-risk or beginner-level trading.

- Example: If EUR/USD is trading at 1.2000, buying one nano lot means you’re controlling 100 EUR, and a 10-pip movement would yield a modest $0.10 profit or loss.

Learn how to trade forex for beginners.

Why do lots matter in forex trading?

Grasping the concept of lot sizes is more than just technical know-how; it’s central to your success in forex trading. Lot size affects everything from how much money you’re putting at risk to how much margin your broker requires and what kind of returns you can expect. Picking the right size isn’t just about precision; it’s about making sure every trade fits your account size, risk comfort, and broader strategy. Here’s a closer look at why this matters so much:

- Risk Management

Lot size plays a big role in how much money you’re putting on the line with each trade. Bigger lots mean bigger swings both in potential profits and losses, while smaller lots help keep your exposure in check. Choosing the right size helps you avoid overleveraging and keeps your risk at a manageable level. Many experienced traders stick to the 1–2% rule, meaning they risk only a small portion of their total capital on any single trade to stay in the game long-term. - Leverage and Margin

The larger your lot size, the more margin you’ll need to open and maintain the trade. For example, placing a standard lot trade locks up far more margin than trading a mini or micro lot. Knowing how margin requirements scale with lot size is crucial it helps you steer clear of overleveraging, which can quickly snowball into margin calls or unexpected losses if the market moves against you. - Position Sizing

Choosing the right lot size keeps your trades in line with your account size and overall strategy. Traders with smaller accounts often stick to micro or nano lots to protect their capital and stay flexible. On the other hand, seasoned traders with more experience and higher risk tolerance might opt for larger lots to aim for bigger profits, as long as the setup justifies the risk. It’s all about finding the right fit for your goals and resources. - Profit and Loss Calculation

Each lot size directly affects the value of a pip the smallest price movement in forex. For instance, a 10-pip shift could mean a $100 gain or loss with a standard lot, $10 with a mini lot, and just $1 with a micro lot. Knowing how pip values scale with lot size helps you better predict how market moves will impact your trades, allowing for more precise planning and risk control. - Capital Preservation

Trading with smaller lot sizes gives you more breathing room. It allows your account to weather normal market ups and downs without taking heavy hits, which is key to staying in the game for the long haul. This flexibility can be the difference between lasting through a rough patch and blowing up your account too soon. - Scalability

One of the great things about forex is its scalability. You don’t need a massive account to get started traders can begin with nano or micro lots and gradually scale up as their skills, confidence, and capital grow. It’s a flexible market that meets you where you are and evolves with you as you gain experience. - Psychological Discipline

Lot size doesn’t just impact your account it can also affect your mindset. Trading large positions can trigger stress, panic, or impulsive decisions, particularly for beginners who aren’t used to rapid gains or losses. By starting with manageable lot sizes, you give yourself room to think clearly, stay disciplined, and keep emotions from hijacking your strategy. Emotional control is just as critical as technical skill in trading, and your lot size plays a big role in maintaining it. - Market Liquidity

When dealing with high-volume trades, especially those involving large lot sizes, market liquidity starts to matter more. If your trade size is too big relative to the market’s depth at that moment, you might experience slippage or struggle to get your order filled at your intended price. This can lead to unexpected outcomes, making it essential to consider liquidity when scaling up your positions.

Example: Let’s say you’re trading EUR/USD with a $1,000 account. If you use a mini lot (10,000 units), a 100-pip move would earn or cost you about $100, a significant shift, but still manageable. Now, imagine using a standard lot (100,000 units) instead. That same 100-pip move would result in a $1,000 gain or loss, effectively doubling your account or wiping it out entirely in just one trade. This kind of example drives home why smart lot sizing isn’t just a technical detail; it’s a vital part of balancing opportunity with risk.

How to Calculate Lot Size in Forex

Figuring out the right lot size isn’t just a numbers game; it’s one of the most important ways to manage risk and make sure each trade fits your overall plan. Lot size dictates how much currency you’re putting on the line and how much you gain or lose with every pip move. To calculate it properly, traders often rely on a simple but powerful formula:

Lot Size = (Account Equity × Risk Percentage) ÷ (Stop Loss in Pips × Pip Value)

This formula allows traders to determine the appropriate position size based on three key factors:

- Account Equity – your total trading account balance

- Risk Percentage – how much of your account you’re willing to risk on a single trade (typically 1–2%)

- Stop Loss in Pips – the distance between your entry price and stop loss

- Pip Value – the monetary value of each pip, based on the currency pair and lot size

Example:

If you have a $5,000 trading account, risk 2% per trade, use a 50-pip stop loss, and each pip is worth $0.10 (typical for a micro lot), the calculation would be:

Lot Size = (5,000 × 0.02) ÷ (50 × 0.10) = 100 ÷ 5 = 20 micro lots

This means you can safely trade 20 micro lots without exceeding your risk limit.

Most trading platforms do the math for you, automatically calculating lot size based on your trade setup. Still, many traders, especially those who are just starting out or juggling multiple currency pairs, prefer to double-check with dedicated lot size calculators. These tools help ensure accuracy and consistency, making it easier to stick to your risk management rules and avoid costly mistakes.

In Summary

Understanding lot sizes and how to calculate them is a must for anyone serious about trading forex effectively. Lot size defines the volume of each trade and plays a direct role in your risk, margin, and potential rewards. Whether you’re just starting out with micro or nano lots or trading standard lots with more confidence, picking the right size helps you stay disciplined, protect your capital, and make the most of your strategy.

By taking the time to evaluate your account size, risk comfort, and overall trading strategy, you can pinpoint the lot size that truly fits your goals. Mastering this skill gives you more control over your trades and helps you make decisions that are not only smarter but also more sustainable in the long run.

Start trading with confidence equipped with a solid understanding of lot sizes and how to size your trades wisely. It’s your first step toward building consistency, managing risk, and finding long-term success in the world’s most liquid and fast-moving financial market.

Frequently Asked Questions (FAQs)

1. What are lot sizes in forex?

In forex, a lot is simply a standardized unit that defines how much of a currency pair you’re buying or selling. But it’s more than just a number—it directly affects the size of your position, the level of risk you’re taking on, and the potential reward. Learning how to calculate and choose the right lot size ensures that each trade fits your account balance, risk appetite, and overall strategy—paving the way for smarter risk management and steadier performance.

2. How do I calculate lot size in forex?

To calculate the appropriate lot size in forex, use the following formula:

Lot Size = (Account Equity × Risk Percentage) ÷ (Stop Loss in Pips × Pip Value)

This calculation ensures your position size aligns with your risk management strategy, helping you control exposure and protect your trading capital.

3. What are the types of lot sizes in forex?

In forex trading, there are several types of lot sizes, each representing a different amount of the base currency being traded:

- Standard Lot – 100,000 units of the base currency.

- Mini Lot – 10,000 units of the base currency.

- Micro Lot – 1,000 units of the base currency.

- Nano Lot – 100 units of the base currency.

Each lot size offers varying levels of risk and reward, allowing traders to choose the size that best fits their account balance, risk tolerance, and trading strategy.

Disclaimer: This post is for educational purposes only and is not financial, legal, or tax advice. Do your own research or consult a qualified professional before making any decisions.

Affiliate Disclosure: GetJoeMoneyRight.com is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com and affiliated sites.