The Shocking Truth About Day Trading: Why the Odds Are Stacked Against the Average Joe

How chasing quick profits can destroy your wealth—and why passive investing is the smarter path to financial freedom

Get Joe Money Right is an email newsletter dedicated to helping the average Joe master their money. Some installments are free, others are for paid subscribers only. Sign up here:

If you’ve ever thought about trading stocks all day, hoping to beat the market and become your own boss, you’re not alone. But here’s the cold, hard truth: the odds are overwhelmingly against you. Today, we’re peeling back the curtain on day trading and showing you why most retail traders lose money—and how a simple, passive index fund strategy might just be the smartest move you can make.

Welcome to an inside look at what happens when “smart money” meets a world of emotional impulses, biased decision-making, and an uphill battle against institutional giants. It’s time to get real about day trading and, more importantly, how you can secure your financial future without risking it all.

Table of Contents

Technical and Structural Pitfalls: Trading in a No-Man’s Land

Short-Term Trading vs. Long-Term Investing: The Ultimate Showdown

The Modern Trading Landscape: Retail Platforms and Market Conditions

Introduction: The Day Trading Mirage

Let’s cut through the hype. Day trading is sold as the ultimate way to get rich quick—an enticing promise for anyone tired of the daily grind. But for most everyday people, the reality is far less glamorous. The truth is, while a few elite professionals manage to carve out consistent profits, the vast majority of retail day traders lose money.

Think about it: Have you ever seen a day trader brag about a consistent six-figure income? Chances are, you haven’t. In fact, research shows that less than 1% of day traders make predictable profits over the long run. This isn’t just rumor or exaggeration—it’s a well-documented fact backed by extensive studies. And if you’re looking for hard numbers, check out the groundbreaking research by Barber et al. (2014) and Chague et al. (2019).

This post will walk you through the many reasons why the everyday retail trader is set up to fail. And by the end, you’ll understand why passive index fund investing—not high-octane day trading—is the proven path to long-term wealth. So buckle up, and let’s dive into why the odds are stacked against day trading success.

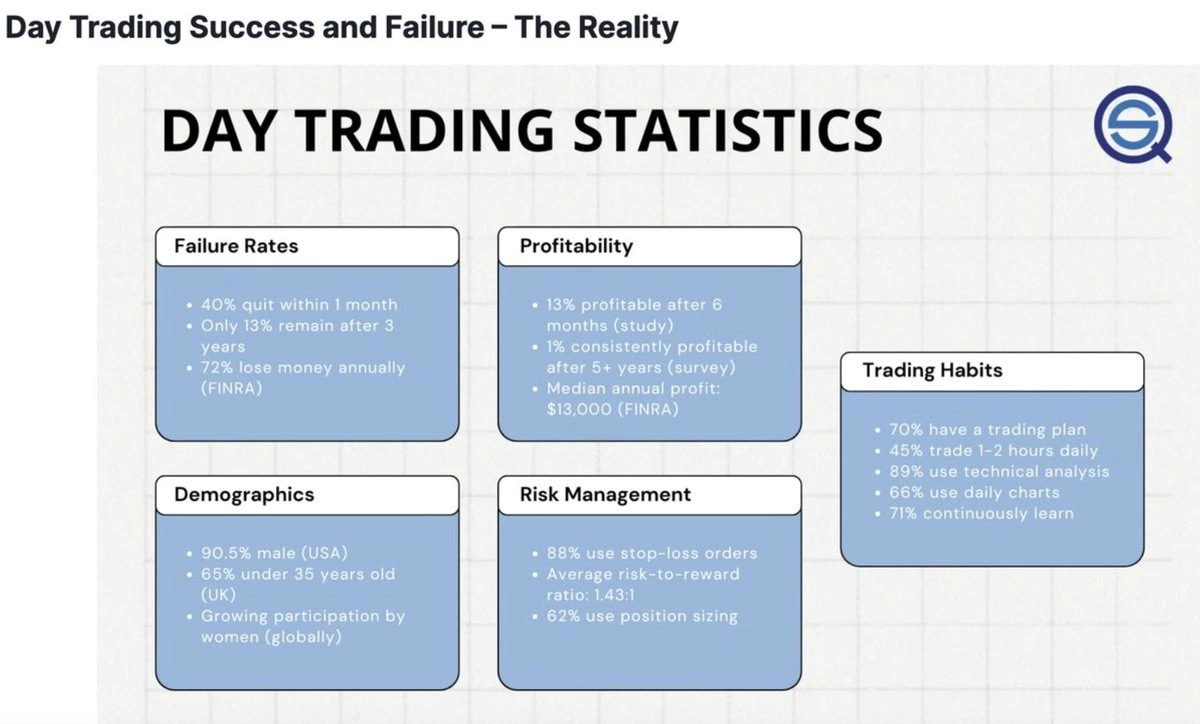

The Stark Reality: Day Trader Success Rates

Let’s start with the numbers. It might sting a little, but the data is clear: most day traders lose money.

Taiwan Stock Exchange Study: A landmark study on Taiwanese day traders revealed that only about 3% turned a profit on any given day—and less than 1% made consistent profits over a year. Read more about the study here.

U.S. Broker Data: U.S. data paints a similarly grim picture. Research shows that over 95% of retail day traders eventually lose money, with many underperforming the market by as much as 10% annually. Investopedia offers insights that echo these statistics.

Brazilian Equity Futures: A study of Brazilian day traders found that a staggering 97% lost money, with a mere 0.4% earning more than what a bank teller might make in a day. Check out more details here.

These numbers aren’t just statistics—they’re a wake-up call. They reveal a stark reality: day trading is a high-risk, high-stress game where the odds are stacked against you from the start.

The Psychological Battlefield: Emotions at the Helm

Now, let’s talk about something that every trader faces but few discuss openly: the mind games.

Emotions Overwhelming Rationality

Every day, retail traders face a barrage of emotional stress that can wreck even the best-laid plans. The fast-paced environment of day trading brings with it intense bouts of greed and fear. One minute, you’re riding a winning trade, and the next, you’re gripped by panic as the market turns against you.

Greed: The allure of massive, rapid profits can blind you to the risks. When a trade starts going well, the temptation is to hold on too long, expecting even more gains. But this is where things get dicey.

Fear: Conversely, when a trade turns sour, fear can take over, making you exit prematurely or double down on a losing position.

Even seasoned professionals can fall prey to these emotions, but for the everyday Joe, it’s often the start—and the end—of the trading journey. The key takeaway? Emotional discipline is the rare trait that sets a few apart from the many. And if you’re not naturally wired for the constant roller coaster of day trading, you’re likely to find yourself overwhelmed.

The Price of Overconfidence

There’s a common trap in day trading: overconfidence. Many traders, after a few lucky wins, start to believe they have a special insight into the market. This overconfidence leads to taking on more risk than is wise. Research from Barber & Odean (2000) shows that the more frequently individuals trade, the worse they perform, largely because of this overconfidence.

In simple terms, when you start feeling like you’re the smartest person in the room, it’s a red flag. Overconfidence makes you ignore warning signs, gamble more aggressively, and ultimately, lose more money.

Behavioral Traps: Cognitive Biases That Kill Your Portfolio

Let’s get a bit scientific—but in plain language. Behavioral finance research tells us that our minds are riddled with biases that distort our decision-making. These aren’t just academic curiosities; they’re the very real, hidden enemies of day traders.

Overconfidence Bias

We just touched on this, but let’s drill in deeper. Overconfidence is not only about feeling invincible—it leads you to trade too often and take on risks you shouldn’t. This bias causes many retail traders to ignore the basic math: if you’re losing money 95% of the time, that’s not skill; it’s a trap.

The Gambler’s Fallacy

Ever thought that after a series of losses, a win is “due”? That’s the gambler’s fallacy at work. Many day traders believe that the market will eventually “balance out,” and a losing streak means a win is on the horizon. Unfortunately, each trade is an independent event—no matter how many times you’ve lost, the next trade doesn’t have a better chance of winning. This fallacy can lead you to double down on losses, thinking you’re on the verge of a turnaround.

Loss Aversion and the Disposition Effect

We naturally hate losing more than we enjoy winning. In trading, this translates into a stubborn refusal to cut losses and a premature sale of winning positions. Known as the disposition effect, this bias means you’re more likely to hold on to losers, hoping they’ll rebound, while selling winners too soon to “lock in” a profit. The result? Your small wins are outweighed by massive losses.

Confirmation and Anchoring Biases

Finally, many traders only seek out information that confirms their existing beliefs (confirmation bias) and fixate on certain numbers or price levels (anchoring bias). This means you might ignore new data that suggests you’re wrong, or you might cling to outdated ideas about where a stock should be trading. These biases narrow your perspective, making it hard to adapt when the market shifts.

These cognitive traps aren’t just quirks of human nature—they’re systematic hurdles that make it nearly impossible for the average retail trader to overcome the odds.

Technical and Structural Pitfalls: Trading in a No-Man’s Land

If the psychological and behavioral factors weren’t enough, let’s talk about the technical side of day trading. The playing field is rigged—not by malicious intent, but by market structure itself.

Flawed Trading Strategies

Many retail traders jump into day trading without a proven system. They chase hot tips from “gurus” or rely on overly simplistic technical analysis, only to find that the market is far too unpredictable in the short term. Studies have shown that the edge held by professional traders often evaporates when retail traders try to replicate it. Essentially, when you use the same strategies as everyone else, you’re unlikely to stand out—and even if you do, the competition is fierce.

The High-Speed Advantage of Institutions

Let’s face it: if you’re trading from your living room while a hedge fund is trading from a high-speed server co-located next to an exchange, you’re at a serious disadvantage. High-frequency trading firms use advanced algorithms to exploit tiny price differences in milliseconds—something no individual can match. This technological gap means that by the time you click “buy,” the window of opportunity has already closed.

Poor Execution and Slippage

Even if you have a decent strategy, execution matters. In fast-moving markets, prices can change in the blink of an eye. This leads to slippage, where you get in or out of a trade at a worse price than expected. For a day trader relying on razor-thin margins, even a small amount of slippage can turn a winning trade into a loss.

Structural Costs and Fees

You might have heard that many brokers now offer “commission-free” trading. While that sounds great, it’s not the full story. Every trade still has costs—be it through bid-ask spreads, slippage, or hidden fees. In day trading, where you might make dozens of trades a day, these costs add up quickly. In fact, research indicates that when you factor in all these costs, the expected value of a day trading strategy is often negative. Investopedia explains more about these hidden costs.

The Isolation of Retail Trading

Unlike institutional traders who benefit from teamwork, data feeds, and risk management systems, retail day traders are often left to fend for themselves. Trading from home means you’re dealing with market shifts, emotional roller coasters, and technical glitches all on your own. Without the infrastructure that professional traders enjoy, even a good strategy can fall apart in the face of unforeseen challenges.

Financial Follies: Capital, Leverage, and the Risk of Ruin

Let’s talk money. More specifically, let’s talk about how much money you’re risking—and why that’s a huge problem for the average day trader.

Starting With Too Little Capital

A common story among retail traders is starting with a small account—maybe a few thousand dollars at best. The pressure to make a significant profit quickly with limited funds leads many to use high leverage. But here’s the deal: using leverage is like walking a financial tightrope. It magnifies both gains and losses. If you’re already starting small, a few bad trades can wipe out your account in a flash.

The Leverage Trap

Many day traders are lured by the promise of magnified gains through leverage. However, the flip side is that the same leverage can lead to catastrophic losses. With a margin account, a small adverse market move can trigger a margin call, forcing you to sell at a loss or even lose more than your initial investment. Research from ESMA has repeatedly shown that retail traders using high leverage (especially in CFD trading) are among the most likely to lose money.

The Hidden Costs of Frequent Trading

Even if you’re trading commission-free, remember that every trade carries hidden costs. The cumulative effect of slippage, spreads, and the higher tax rate on short-term gains can take a serious bite out of your profits. In contrast, long-term investors benefit from lower transaction costs and more favorable tax treatment. It’s a numbers game—and the numbers just aren’t in favor of the typical day trader.

Inconsistent Income and the Pressure to Keep Trading

Let’s be honest: day trading is not a steady paycheck. You might have days of small wins, followed by days when the losses pile up. That inconsistency can create immense pressure to “make it back” quickly, leading to even riskier trades and a vicious cycle of losses. It’s no wonder that many day traders eventually give up—when every day feels like a high-stakes gamble, the emotional and financial toll becomes too much to bear.

Short-Term Trading vs. Long-Term Investing: The Ultimate Showdown

So, where does this leave you? On one side, you have the high-risk, high-stress world of day trading. On the other, there’s the more reliable, long-term strategy of passive investing. Let’s compare the two.

The Day Trading Equation

Time Horizon: Seconds to a single day. You’re forced to make split-second decisions based on fleeting market movements.

Volatility: Sky-high. Your account might swing wildly in value on any given day.

Risk-Adjusted Returns: Typically negative. Studies show that most day traders have negative Sharpe ratios because they take on too much risk for the small gains they manage to eke out.

Costs: High. Frequent trades mean frequent fees, slippage, and taxes eating away at your returns.

Emotional Toll: Massive. The constant pressure and quick decisions can lead to burnout and reckless behavior.

The Passive Investing Advantage

Time Horizon: Years or decades. Your money has time to grow and compound, smoothing out short-term volatility.

Volatility: Much lower. While market fluctuations exist, the long-term trend is generally upward.

Risk-Adjusted Returns: Proven and positive. Historical data shows that a diversified index fund, like the S&P 500, has delivered around 7–10% annual returns—far outperforming the average day trader.

Costs: Minimal. With fewer trades, you incur fewer fees, and tax treatment is more favorable for long-term investments.

Emotional Toll: Significantly lower. Once you’ve built a diversified portfolio, you can largely ignore daily market noise and let compounding work its magic.

In short, while day trading might seem thrilling and the promise of quick riches is alluring, the numbers simply don’t add up in favor of most retail traders. On the flip side, a passive index fund strategy is like betting on the long-term growth of the economy—a bet that, historically, has almost always paid off.

For more details on these comparisons, check out insights from DeVore’s analysis on the probability of gains over different time horizons and my article on variance drain.

The Modern Trading Landscape: Retail Platforms and Market Conditions

The landscape of trading has changed dramatically in recent years, largely due to the rise of retail trading platforms like Robinhood. While these apps have democratized access to the markets, they’ve also added a new layer of complexity—and risk—for everyday traders.

The Rise of Commission-Free Trading

Remember the days when you paid a fee for every trade? Those days are over. Platforms like Robinhood have eliminated commissions, enticing millions of new traders with the promise of free trading. But there’s a catch. While it’s easier to make a trade, it’s also easier to make impulsive, poorly thought-out decisions. Learn more about the phenomenon here.

Gamification: Turning Trading Into a Game

These apps aren’t just about convenience—they’re designed to be engaging, even addictive. With flashy animations, notifications, and leaderboards, day trading on these platforms can feel more like playing a video game than managing your finances. This “gamification” of trading can lead to overtrading, where the excitement of every little move overshadows careful decision-making.

Retail Trading in a Bull Market—and the Crash That Follows

Let’s not forget: the recent bull market attracted scores of amateur traders. When the market was riding high, everyone felt like a genius. But once market conditions shifted, those same traders faced harsh realities. The rush into day trading during a bull run often sets up a painful downfall when volatility increases and the market corrects itself. In many ways, retail traders are caught in a structural trap—drawn in by easy money and then left vulnerable when the tide turns.

Leverage and the Danger of Overextension

Access to leverage has never been easier, but this “too much, too soon” mentality can be a killer. Many retail platforms offer significant leverage, meaning that a small adverse move can obliterate your account. For an everyday trader, this is a recipe for disaster. The data from ESMA makes it clear: high leverage, while promising bigger gains, is almost always a path to big losses for those who don’t have the discipline of professional traders.

Why Passive Index Investing Is Your Best Bet

After laying out all the reasons why day trading is a near-guaranteed recipe for disappointment, here’s the contrarian truth: if you’re an average investor looking to grow your wealth, the best strategy isn’t chasing hot stocks or trying to beat the pros at their own game—it’s simply putting your money in a diversified index fund.

The Power of Compounding

Passive index investing leverages the magic of compounding. By staying invested for the long haul, your returns build on themselves year after year. You’re not trying to time the market or outsmart it—just letting the economy do what it does best: grow. Historical data backs this up. For instance, holding a broad market index like the S&P 500 for 15 years has nearly a 100% chance of yielding positive returns. Read more on historical trends here.

Lower Costs, Lower Stress

With passive investing, you make far fewer trades. This means you avoid the hidden costs, tax penalties, and emotional stress of constant trading. No more worrying about missing a crucial market move or panicking over a single bad day. Instead, you can enjoy the peace of mind that comes from knowing your money is working steadily and safely for you.

A Strategy That Beats the Odds

Let’s be honest: if you’re the average Joe with a day job, a family, and other responsibilities, you probably don’t have the time, discipline, or resources to compete with professional traders or high-frequency trading algorithms. But you do have the ability to invest passively and let your money grow over time. By avoiding the pitfalls of day trading, you’re not only protecting your capital—you’re positioning yourself to benefit from the long-term growth of the market.

The Insider’s Edge: Recognize What You Don’t Know

The world of day trading is a high-speed arena where the players with the most resources, the best technology, and the sharpest reflexes dominate. Real savvy investors know that admitting you don’t have the edge is actually the first step toward success. Instead of fighting an uphill battle against the market, put your money in a diversified index fund and let the market’s upward trend do the heavy lifting.

Conclusion: Don’t Gamble With Your Future

Here’s the bottom line: the odds of success in day trading are not just slim—they’re almost nonexistent for the average person. Between the psychological roller coaster, the behavioral pitfalls, the technical challenges, and the structural disadvantages, day trading is a minefield where most retail traders eventually lose more than they gain.

If you’re tempted by the promise of quick riches through day trading, take a step back and ask yourself: Is this really the best use of my time and money? The data is crystal clear, and the research from Barber et al. (2014) and Chague et al. (2019) doesn’t lie. The odds are stacked against you.

For the everyday investor who wants to build lasting wealth without the constant stress and high risk of day trading, there’s a proven path forward: passive index fund investing. It’s simple, it’s reliable, and it’s been the backbone of smart financial strategies for decades.

Don’t fall for the glamorous day trading myth. Instead, take control of your future by making an informed, rational decision. Invest in a diversified index fund, sit back, and let the power of compounding work for you.

As a savvy investor, you deserve more than the high-risk gamble of day trading. You deserve a strategy that has stood the test of time—one that doesn’t rely on chasing trends or outsmarting professional traders, but on the slow, steady, and reliable growth of the market.

So, the next time you’re tempted to jump into a hot stock tip or chase the latest day trading trend, remember: the odds are not in your favor. Your time and money are far better spent in a low-cost, diversified index fund that will give you the financial freedom and security you deserve.

Resources for Further Reading

For those who want to dive deeper into the research and numbers behind these claims, here are some valuable resources:

Final Word

The market isn’t a casino where you can count on luck to make you rich overnight. It’s a complex system where only those with the right tools, discipline, and edge survive. For most of us, that edge is found in embracing a simple, proven strategy—passive index investing. So, if you’re serious about securing your financial future, it’s time to get smart, cut out the noise, and invest like the savvy investor you truly are.

Remember, the smart money isn’t chasing fleeting trends—it’s sitting on them, letting compound growth work over the long haul. Don’t gamble with your future when you can secure it with a strategy that’s been tried, tested, and proven time and time again.

Want more insights like this delivered straight to your inbox? Subscribe to Get Joe Money Right and never miss a post! Each week, I break down investing, wealth-building, and financial strategies in a way that makes sense for everyday people like you and me. The smart money moves fast—make sure you're staying ahead of the game.

Disclaimer: This post is for educational purposes only and does not constitute financial advice. Always do your own research or consult a professional advisor before making investment decisions.