Variance Drain Explained: How Volatility Decay Slowly Destroys Your Portfolio

The Hidden Tax on Your Investments: A Deep Dive into Variance Drain and Its Impact on Your Wealth

Hello, savvy investors and fellow average Joes alike! If you’ve ever scratched your head wondering why your investment returns seem to fall short of what you’d expect, you’re not alone. Today, we’re cutting through the noise and taking a hard look at a sneaky, often misunderstood force in the world of finance: variance drain (also known as volatility drag). This isn’t some Wall Street mumbo-jumbo—this is real math that affects every investor’s bottom line. And if you’re serious about building wealth, understanding it is non-negotiable.

In this deep dive, we’re going to break down everything you need to know about variance drain. We’ll cover how compounding works in volatile markets, quantify the impact with real data and simulations, compare its effects across various asset classes, and—most importantly—discuss practical risk management strategies to fight back. So buckle up, because by the end of this post, you’ll be armed with the kind of insights that set savvy investors apart from the so-called “vanilla” crowd.

Pro Tip: Even if you’re not a math whiz, stick around. We’re going to explain every concept in plain language, backed by hard data and real-world examples.

Table of Contents

Variance Drain Across Asset Classes: Stocks, Leveraged Funds, and Cryptocurrencies

What Does This Mean for You? Actionable Takeaways for the Average Joe

The Big Picture: Why Variance Drain Matters in the Real World

What Is Variance Drain?

Let’s start with the basics. Variance drain, or volatility drag, is a mathematical phenomenon that explains why the compounded (or geometric) return of an investment is often lower than its simple average (arithmetic) return. In plain language, even if your portfolio shows a high average return on paper, the ups and downs—the volatility—can actually erode your wealth over time. Think of it as a hidden tax that sneaks in whenever your investment values swing wildly.

Breaking It Down for the Everyday Investor

Imagine you have a magic money machine that gives you a 50% gain one day and then a 50% loss the next. On paper, you’d say you’re averaging 0% per day (50% gain + (-50% loss) = 0%), right? But here’s the kicker: if you start with $100, a 50% gain takes you to $150, and then a 50% loss drops you to $75. Ouch! Even though the average return is 0%, you’re left with only 75% of your original money. That’s variance drain in action.

This drag happens because of the nature of compounding. When returns are volatile, losses hurt more than gains help. A drop in value means there’s less money to grow later, and the recovery needed is proportionally larger. In other words, the order in which returns occur matters—a lot.

A Quick Mathematical Glimpse

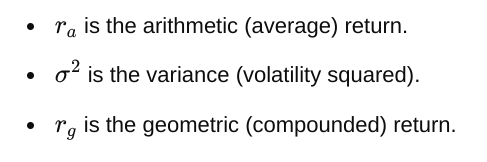

The effect of volatility on compounded returns is often approximated by the formula:

This equation might look a bit intimidating, but it essentially tells us that the higher the volatility, the larger the “drag” on your returns. For everyday investors, this means that an asset with a high average return but high volatility might not compound as well as a steadier asset with a slightly lower average return.

Want to dig deeper? Check out this straightforward explanation on Bogleheads’ Variance Drain for a closer look at the numbers.

The Math Behind the Magic: Compounding in Volatile Markets

Now, let’s roll up our sleeves and dive into how compounding really works when markets get bumpy.

Understanding Compounding: More Than Just Adding Up Numbers

Compounding is the process where your investment returns start to generate their own returns. It’s the key reason why money grows exponentially over time. But—and here’s the big but—when your returns are all over the place, the magic of compounding can actually work against you.

Imagine you have two scenarios:

Steady Growth: You invest $100 and earn 10% every year, no ups and downs.

Volatile Growth: You invest $100 and earn +20% one year, then –10% the next year, alternating.

In the steady scenario, after two years you’d have:

In the volatile scenario, you’d get:

Even though the average return in the volatile scenario is the same (about 10% per year), the compounding effect leaves you with less money because of the losses that aren’t fully recovered by the gains.

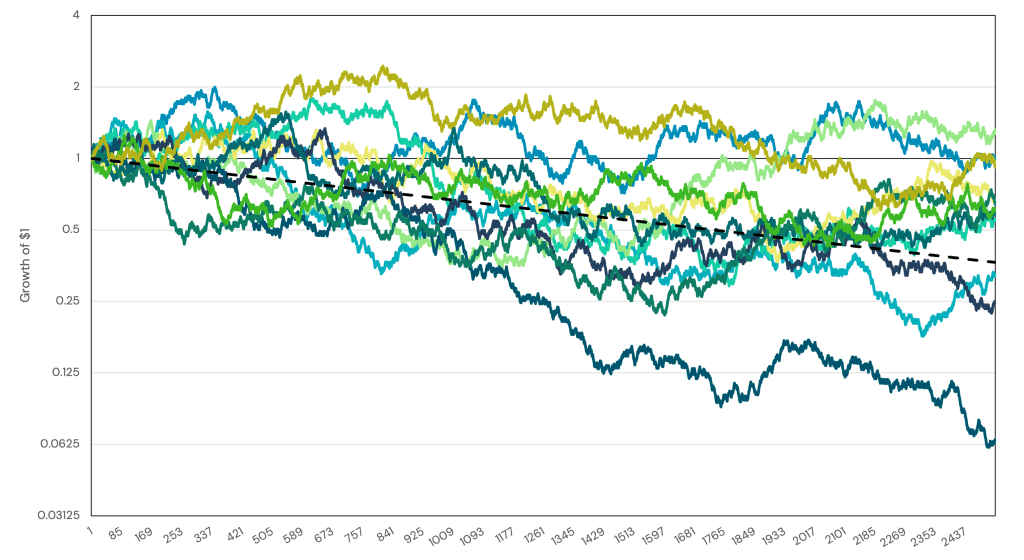

Monte Carlo Simulations: A Real-World Look at Variance Drain

To see variance drain in action, consider a Monte Carlo simulation. This method uses random sampling to simulate thousands of possible outcomes based on given inputs (like average return and volatility). When you simulate an investment that has a 0% average daily return but swings by ±2% every day, the majority of simulated paths end up showing a decline over time.

Why? Because the occasional losses, even if balanced by gains on paper, drag down the compounded return. Most simulated paths don’t just average out to 0—they actually trend downward. This isn’t a flaw in the simulation; it’s a mathematical reality that every investor needs to be aware of.

If you’re curious to learn more about these simulations, Return Stacked’s article on Return Stacking and Volatility Drag offers an excellent deep dive into how these models work and what they reveal about variance drain.

Real Numbers: A Tale of Two Investments

Let’s break out some real numbers to see how variance drain works over a longer period. Suppose you have an asset with:

An arithmetic average return of 10%.

An annual volatility of 20%.

Plug these numbers into our formula:

So, while the average return is 10%, the expected compounded return is closer to 8% per year. Now, consider the real-world performance of the S&P 500 between 2007 and 2016. Its arithmetic average return was roughly 8.75%, but due to volatility drag, the actual compounded (geometric) return was about 6.94%. That’s a gap of nearly 1.8% per year—money that’s effectively “lost” to volatility.

For a detailed breakdown of how these figures come about, Kitces’ blog post on Volatility Drag explains the nuances with clarity.

Variance Drain Across Asset Classes

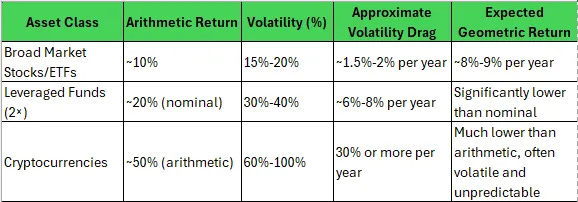

Variance drain doesn’t discriminate—it affects all asset classes, but the impact can vary widely. In this section, we’ll compare how volatility drag plays out in stocks, leveraged funds, and even cryptocurrencies.

Stocks and ETFs: The Steady Contenders

Stocks are the bread and butter of most investment portfolios. A broad market index like the S&P 500 typically shows annual volatility in the range of 15% to 20%. While stocks have historically provided solid returns, their volatility means that the compounded (geometric) returns are always a bit lower than the arithmetic averages suggest.

Example: Over a long period, the S&P 500 might have an arithmetic return of around 11%, but after accounting for volatility drag, the geometric return might be closer to 9%.

Key Insight: Even though you’re still making money, that hidden drag can significantly reduce your wealth over decades.

ETFs, which often track these indexes, inherit the same properties. They’re a great way for everyday investors to access diversified stock portfolios, but they’re not immune to variance drain. Understanding this drag can help you set realistic expectations for your long-term goals.

Leveraged Funds: The Double-Edged Sword

Now, let’s talk about leveraged funds. These products, such as 2× or 3× leveraged ETFs, are designed to magnify daily returns. Sounds great, right? More return per day! But here’s the catch: leverage also magnifies volatility, and that means variance drain skyrockets.

For a 2× leveraged fund, the drag doesn’t just double—it can quadruple. The math behind this is straightforward: if you double your exposure, the variance (volatility squared) increases by a factor of four. For example, if the underlying asset has a 10% arithmetic return and 20% volatility, the 2× fund might see a compounded return that is far lower than simply double the unleveraged return. In some cases, even if the underlying asset is up over a period, the leveraged version could underperform due to the compounded volatility losses.

This phenomenon is why leveraged ETFs are generally recommended for short-term trading rather than long-term holding. For a detailed explanation, check out Shepherd Financial Advisors’ guide on volatility drag in leveraged funds.

Cryptocurrencies: The Wild West of Volatility

Cryptocurrencies, like Bitcoin and Ethereum, are known for their wild price swings. With annualized volatilities often reaching 60% to 100% or more, variance drain is a major concern. Even if a cryptocurrency shows a stellar arithmetic average return, the actual compounded return can be severely eroded by extreme volatility.

Real-World Impact: Imagine an asset that, on average, returns 50% per year with an 80% volatility rate. The drag term (½σ²) would be about 32% per year—meaning that without astronomical gains, the actual growth could be much lower.

Reality Check: This is why many crypto investors experience wild swings in portfolio value. The ups may be huge, but the downs can be brutal, and over time, the drag can leave you with much less than expected.

For an in-depth look at how variance drain plays out in crypto markets, Moontower Meta’s blog on the volatility drain is a must-read.

Key Takeaways from Asset Class Comparisons

To visualize these differences, let’s look at a simplified table comparing how variance drain might affect different asset classes:

Note: These figures are illustrative. Actual returns and drag will vary based on market conditions and specific asset characteristics.

This table clearly shows that while stocks and ETFs suffer from volatility drag, the problem is exponentially worse for leveraged funds and cryptocurrencies. The numbers don’t lie: high volatility can drastically cut into the wealth you’d expect to build over time.

Historical Case Studies: Learning from the Past

Now that we’ve built a solid understanding of the theory, let’s get into some real-world examples. History is a great teacher, and when it comes to variance drain, past market cycles show us exactly how this “hidden tax” can impact long-term performance.

The Global Financial Crisis (2008) and Its Aftermath

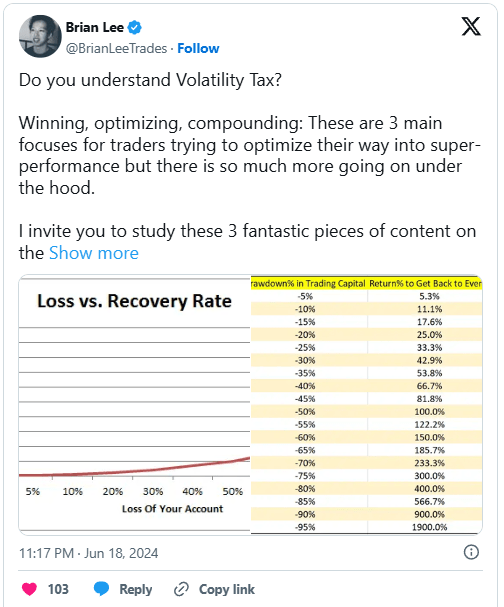

The 2008 financial crisis is perhaps the most famous example of extreme market volatility. In 2008, the S&P 500 plunged by nearly 37%, only to rebound with a 26% gain in 2009. On paper, you might be tempted to average these returns out, but the reality is much harsher due to variance drain.

What Happened: Despite a couple of years where gains seemed to balance out losses, the overall compounded return for investors during this period was significantly lower than what the arithmetic average suggested.

The Impact: Over the 2007–2016 period, the S&P 500 posted an arithmetic average return of about 8.75%, but the compounded return (CAGR) was only around 6.94%. That 1.8% annual gap is the real cost of volatility drag—a drain that left many investors with far less than they had hoped for.

For a detailed analysis of this period, Swanglobal Investments’ article on volatility drag explains how the crisis drove home the importance of managing risk in volatile times.

The “Lost Decade” for Stocks (2000–2009)

The early 2000s weren’t much kinder. The so-called “Lost Decade” for stocks saw the S&P 500 effectively flatline, despite some years with decent gains. This was largely due to the sequential nature of big losses and incomplete recoveries.

Sequential Risk: If you suffer a massive loss—say 50%—it takes a 100% gain to recover. When the market experiences several such drawdowns, the compounded return can be devastating.

Real-World Lesson: Many investors entering the market during this period were caught off guard. Despite hearing that stocks offer a 7%-10% annual return, those who experienced the crashes ended up with a portfolio that barely grew in real terms.

This phenomenon isn’t just a quirk of history—it’s a mathematical certainty when volatility is high. For further reading, Vineyard Global Advisors’ blog on understanding volatility drag lays out these examples in an accessible way.

Emerging Markets and Small Caps: The High-Risk, High-Reward Trap

While emerging markets and small-cap stocks often promise higher returns, they also come with significantly higher volatility. The variance drain on these asset classes can be so severe that the expected benefits of higher returns are largely negated.

Emerging Markets: These stocks might show attractive arithmetic returns, but during periods of crisis (like the late 1990s Asian Financial Crisis), their wild swings mean that the compounded return can be much lower.

Small Caps: Historically, small-cap stocks have outperformed large caps on average, but they also experience more extreme volatility. Investors in small caps need to be especially wary of variance drain because those big swings can wipe out the expected premium.

These lessons highlight why it’s critical to not just chase high returns, but to also consider how volatility can undermine those returns over time.

A Hypothetical High-Volatility Game

Let’s round out our historical case studies with a thought experiment. Imagine an investment game where you have a 70% chance to gain 50% and a 30% chance to lose 40% every round. The arithmetic expected return here might look tantalizing—around +5% per round. But in practice, the geometric (compounded) return turns out to be negative. This is a stark example of how a few big losses can overwhelm frequent gains.

The Takeaway: Even if the numbers on paper look good, the reality of compounding means that the typical outcome (the geometric mean) is what truly matters. Most investors will find that their actual results fall short of the arithmetic averages due to these occasional heavy losses.

These case studies drive home one truth: volatility drag isn’t a theoretical construct—it’s a very real force that has impacted investor fortunes time and time again.

Risk Management Strategies to Combat Variance Drain

Now that we’ve seen the damage volatility drag can do, let’s flip the script. There are powerful strategies you can employ to fight back against this hidden tax. Here’s how you, the average Joe, can protect your portfolio and improve your long-term returns.

1. Diversification: Don’t Put All Your Eggs in One Basket

Diversification is the golden rule of investing. By spreading your money across different asset classes—stocks, bonds, real estate, and even alternative investments—you reduce your overall portfolio volatility. Remember, if you lower volatility, you lower variance drain.

How It Helps: A diversified portfolio smooths out the ups and downs, meaning the compounded (geometric) return is closer to the arithmetic average.

Actionable Tip: Instead of pouring all your cash into high-volatility stocks or cryptocurrencies, mix in lower-volatility assets like bonds or stable ETFs. Even within stocks, aim for a mix of sectors and geographies.

Want a diversified portfolio that helps reduce volatility drag? Ray Dalio’s All Weather Portfolio is a great place to start.

2. Volatility Targeting: Adjust Your Exposure Based on Market Conditions

Smart investors don’t just set and forget their portfolios—they adapt to changing market conditions. Volatility targeting is a strategy where you adjust your asset allocation based on current or expected volatility. When markets are calm, you might be comfortable with higher exposure to stocks. When markets get choppy, you dial back your risk.

How It Works: By reducing exposure during periods of high volatility, you limit the potential drag on your compounded returns.

Real-World Example: Some hedge funds and robo-advisors use risk parity or similar techniques to maintain a stable volatility target. While retail investors might not have access to sophisticated models, you can use simple tools like moving averages or rebalancing rules to achieve a similar effect.

For an in-depth look at volatility targeting, check out Swanglobal Investments’ insights on volatility drag.

3. Options-Based Hedging: Protecting Against Downside

Another powerful tool in the volatility management arsenal is options-based hedging. By using options, you can protect your portfolio from large, unexpected downturns.

Protective Puts: Buying a put option on an index or a key stock gives you the right to sell at a predetermined price, effectively capping your losses. This insurance can save you from the worst of market crashes.

Covered Calls: Writing covered calls on your holdings can generate extra income and reduce volatility, albeit at the cost of some upside potential.

Even though options come with a cost (the premium), this is often a small price to pay for peace of mind. For more details on how hedging works to mitigate variance drain, Shepherd Financial Advisors’ article is a great resource.

4. Regular Rebalancing: Keep Your Portfolio on Track

Rebalancing is the periodic adjustment of your portfolio to maintain your target asset allocation. It forces you to sell portions of investments that have outperformed (and become riskier) and buy those that have underperformed (and are now relatively cheaper).

Why It Works: Rebalancing helps keep your overall portfolio volatility in check, thereby reducing the long-term effects of variance drain.

Actionable Steps: Many investors set a schedule—quarterly, semi-annually, or annually—to review their portfolios and make adjustments. Automated tools and robo-advisors can do this for you if you prefer a hands-off approach.

Even a simple rebalancing strategy can make a big difference over time, ensuring that you’re not caught off guard when volatility spikes.

5. Keeping Emotions in Check: The Psychological Angle

One of the biggest culprits in variance drain isn’t even the math—it’s our emotions. When markets swing, many investors panic, sell at the bottom, and then miss out on the recovery. Maintaining a long-term focus and sticking to your strategy is crucial.

Stay Disciplined: Resist the urge to make impulsive decisions based on short-term market noise.

Plan Ahead: Have a written investment plan that outlines what you’ll do in different market conditions. This plan can act as a safeguard against emotional decisions that could exacerbate volatility drag.

What Does This Mean for You? Actionable Takeaways for the Average Joe

Alright, enough theory—let’s talk about how this matters for you. If you’re an everyday investor trying to build wealth over time, here’s what you need to know about variance drain and how to beat it.

Don’t Be Fooled by “Average” Returns

The headline numbers you see—like “stocks return 10% per year on average”—don’t tell the whole story. Because of variance drain, the actual growth (the compounded return) you experience can be much lower. Always ask yourself: What’s the real growth rate, and how much drag is volatility imposing on my portfolio?

Think Long-Term and Diversify

Remember, variance drain is cumulative. Small differences add up over time. That’s why:

Diversification is essential: Spread your risk across different asset classes.

Long-term focus matters: Stick to a plan, even when markets get choppy.

Be Cautious with High-Volatility Bets

If you’re tempted by high-flying assets like leveraged ETFs or cryptocurrencies, proceed with caution. They might promise high arithmetic returns, but the volatility can eat away at your wealth through variance drain. If you decide to invest in these, make sure they represent only a small portion of your overall portfolio.

Manage Your Portfolio Like a Pro

Even if you’re not a Wall Street hotshot, you can still use strategies like volatility targeting, rebalancing, and hedging to protect your investments. These are not exotic techniques—they’re tools that any smart investor can use. By keeping your portfolio’s volatility in check, you maximize the benefits of compounding.

Don’t Let Emotions Drive Your Decisions

The market is unpredictable. Instead of reacting to every swing, develop a strategy and stick with it. Avoid the temptation to panic sell or chase the next hot tip. The best way to combat variance drain is a disciplined, well-thought-out investment plan.

Real-World Examples and Personal Anecdotes

Let me share a story. A few years ago, I got caught up in the hype of leveraged ETFs and speculative plays like many others. At the time, it seemed like a golden opportunity—daily leveraged gains meant more money, right? Wrong. I watched my portfolio swell during short-term rallies, only to see it evaporate in market downturns. I didn’t realize how variance drain was quietly eating away at my returns until it was too late.

Take, for example, traders in this Reddit thread discussing their experience holding leveraged funds like BOIL for over a year. They expected massive long-term gains but ended up struggling with significant losses due to volatility drag. It’s a textbook example of how even assets that move in the “right” direction can still leave you in the red if volatility is too high.

I learned the hard way that being a smart investor isn’t about chasing the highest possible returns—it’s about keeping what you earn and letting it compound over time. Had I read the article you are reading now and seen this video, it would have saved me a lot of time, money, and stress. Since then, I’ve reshaped my approach to prioritize diversification, rebalancing, and managing risk effectively. Today, I invest with a long-term mindset, knowing that by controlling volatility, I’m giving myself the best chance at real wealth growth.

For those of you considering speculative high-volatility plays, remember this: it’s not about how much you can make in a single year, but how much you can consistently compound over decades.

The Big Picture: Why Variance Drain Matters in the Real World

Let’s zoom out for a moment. Every investor—whether you’re a beginner or a seasoned pro—faces the challenge of volatility. The world of finance is full of noise, and mainstream media often oversimplifies the message: “Invest in stocks, they yield 10% per year!” But that’s only part of the story.

When you dig deeper, you see that volatility isn’t just a side effect—it’s a hidden force that can fundamentally alter your financial destiny. Mainstream narratives tend to ignore the compounded effect of volatility, leaving everyday investors underprepared for the true challenges of building wealth.

In contrast, those of us who understand variance drain know that every percentage point matters. A 1% difference in compounded returns might seem small at first, but over 30, 40, or 50 years, that gap can mean tens or even hundreds of thousands of dollars. That’s the power of compounding—and the silent, creeping impact of volatility drag.

The bottom line is this: if you’re serious about growing your money, you have to respect the math. Understand that volatility is not your friend; it’s a hidden cost that chips away at your gains. And once you grasp that, you’ll start taking steps to mitigate it—whether through diversification, smart rebalancing, or hedging.

Resources and Further Reading

I’m a firm believer in doing your own homework. Below are some top-notch resources that helped shape this post. I recommend you check them out for more detailed insights:

Bogleheads’ Variance Drain – A great primer on the math behind volatility drag.

Learn more here.Kitces on Volatility Drag – A deep dive into why the geometric return is always lower than the arithmetic average in volatile markets.

Read the full article.Return Stacked on Return Stacking and Volatility Drag – Explains how volatility erodes returns over time through simulations and real-world examples.

Discover the insights.Shepherd Financial Advisors on Navigating Volatility – A practical guide to understanding and managing variance drain.

Check it out.Swanglobal Investments on Volatility Drag – Breaks down the concept and its impact during market downturns.

Explore the article.Moontower Meta on The Volatility Drain – A compelling explanation of why volatility drag is a real threat to long-term investors.

Read more.Vineyard Global Advisors on Understanding Volatility Drag – Offers practical examples and actionable advice for managing volatility.

Find out more.

Final Thoughts

If you're an average Joe (or Jane) working toward financial freedom, here's the bottom line: variance drain is a hidden cost quietly undermining your wealth-building efforts. This isn't some theoretical concept—it's real, measurable, and can significantly reduce your returns.

Successful investing isn’t about chasing big returns at any cost; it’s about consistency, managing risks, and protecting your capital. Every percentage counts, so savvy investors rely on proven strategies like diversification, regular rebalancing, and hedging to safeguard their investments.

Next time you evaluate an investment, ask yourself: “What's the actual compounded return, and how much is volatility eroding it?” Forget flashy headlines and oversimplified averages—embrace the real math, stay informed, and make investment choices that ensure steady, long-term growth.

Want more insights like this delivered straight to your inbox? Subscribe to Get Joe Money Right and never miss a post! Each week, I break down investing, wealth-building, and financial strategies in a way that makes sense for everyday people like you and me. The smart money moves fast—make sure you're staying ahead of the game.

Disclaimer: This post is for educational purposes only and does not constitute financial advice. Always do your own research or consult a professional advisor before making investment decisions.