Investing Made Simple: Ray Dalio's All Weather Portfolio Explained

How to Build a Portfolio That Thrives in Any Economic Environment

Get Joe Money Right is an email newsletter dedicated to helping the average Joe master their money. Some installments are free, others are for paid subscribers only. Sign up here:

If you're done following the crowd with the tired old "buy and hold" or the predictable 60/40 portfolio everyone seems to swear by, you've landed in the perfect spot. Today, we're peeling back the curtain on Ray Dalio's legendary All Weather Portfolio—no Wall Street jargon, no fluff, just a straightforward breakdown for everyday people like you who want to build a bulletproof portfolio ready for whatever economic storm hits.

In this guide, we'll break down exactly what the All Weather Portfolio is, unpack how it operates, explain the rationale behind its unique structure, and compare it to the widely popular 60/40 approach. You'll get clear, practical insights backed by data and real-world examples, showing why this strategy might just be the smart upgrade your investment plan needs.

What Is the All Weather Portfolio?

A Strategy for Every Economic Climate

The All Weather Portfolio isn’t some “get rich quick” scheme or a secret sauce for overnight wealth. Instead, it’s a thoughtfully crafted mix of assets designed to do one thing: perform well no matter what the economy throws at you. Developed by Ray Dalio and his team at Bridgewater Associates, this portfolio was created in the 1990s when Dalio asked himself one simple question:

“What kind of portfolio would survive—and even thrive—in every economic scenario?”

In a nutshell, the All Weather Portfolio is built on the idea that you don’t have to predict the future to be successful. Rather than betting on a single outcome, you spread your bets across different asset classes that do well in different economic environments. Think of it like having a wardrobe that’s perfect for any weather—rain, shine, or snow.

For a closer look at its origins and the philosophy behind it, check out this insightful article on Of Dollars and Data.

Breaking Down the Asset Allocation

How Does It Work?

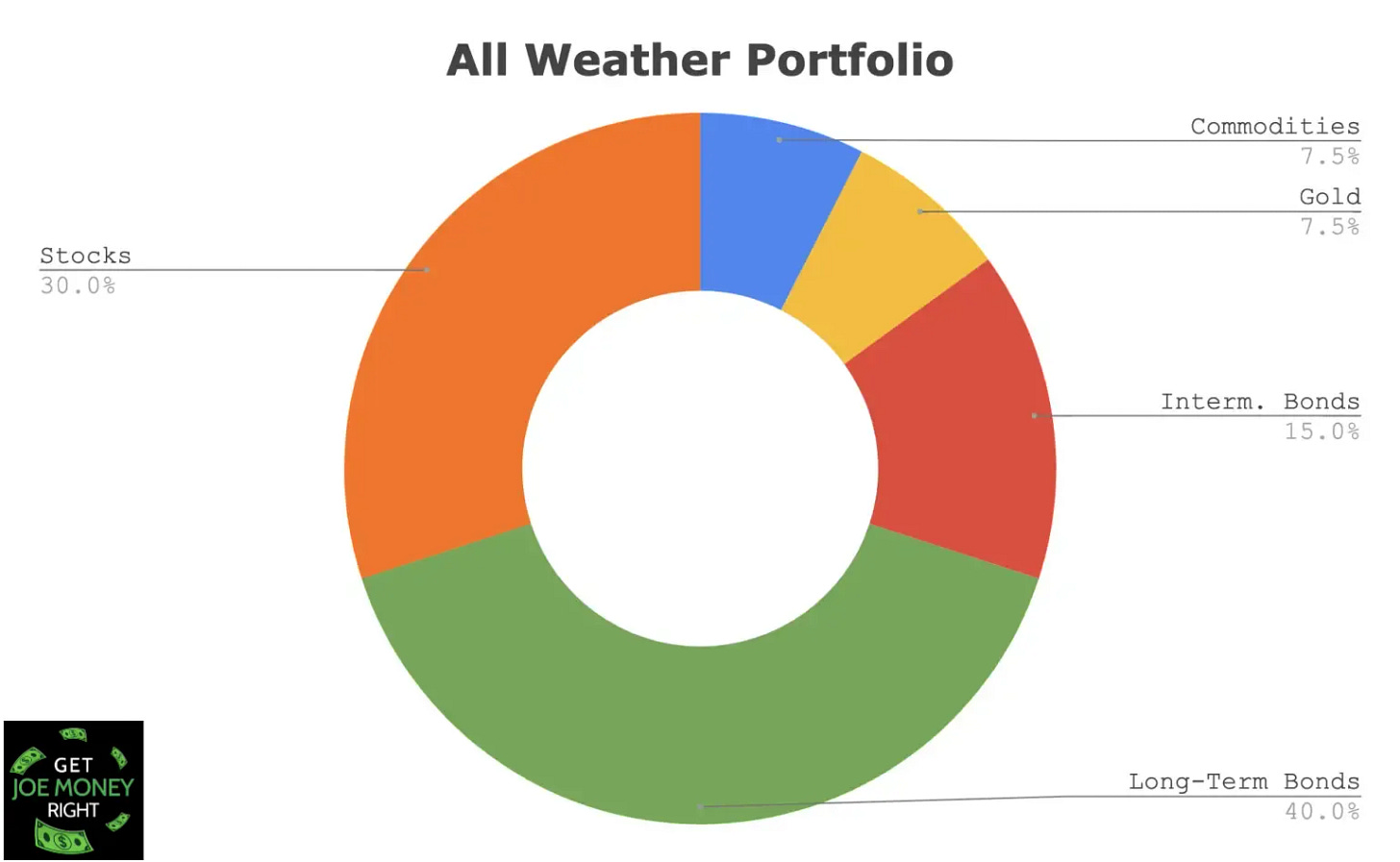

At the heart of the All Weather strategy is a clever asset mix that balances risk across four major economic environments: growth, recession, inflation, and deflation. Here’s the classic breakdown:

30% Equities (Stocks):

Stocks give you the growth you need during good economic times. But in a downturn, they can be a drag. In the All Weather setup, stocks make up only about 30% of your portfolio, which means you get some growth without overexposure to risk.55% Bonds:

This isn’t your average bond holding. The All Weather Portfolio splits its bond allocation between long-term treasuries (about 40%) and intermediate-term treasuries (around 15%). Bonds tend to do well when economic growth slows down or during deflationary periods, acting as a counterbalance when stocks stumble.15% Hard Assets (Gold and Commodities):

Roughly half of this 15% goes to gold, and the other half to a broad basket of commodities. These are your hedges against inflation. When prices start to soar, these assets tend to outperform stocks and bonds.

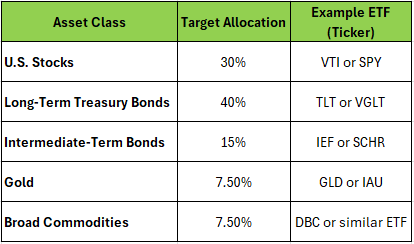

Here’s a quick table showing how you might implement this with ETFs:

Using ETFs makes it simple for anyone to get started without diving into the messy world of individual stock picking or bond trading.

The Economic Logic Behind the Strategy

Risk Parity: Spreading the Risk

Most investors get hung up on trying to guess whether the market is going up or down. But here’s the kicker—no one can predict the future with certainty. Instead of trying to outguess the market, the All Weather Portfolio uses what’s called a risk parity approach.

Risk parity means you don’t just split your money evenly among asset classes; you split the risk. Think of it this way: stocks are like that friend who’s always unpredictable. They can either make you rich or break you. Bonds, on the other hand, are the reliable ones that give steady returns even when things go south. By assigning more capital to less volatile assets (like bonds) and less to more volatile ones (like stocks), you ensure that each component of your portfolio contributes roughly equally to the overall risk.

Dalio’s philosophy is simple: diversify so that no single economic event can wipe you out. For more on risk parity and its application, take a look at this detailed resource from Papers with Backtest.

How the All Weather Portfolio Handles Economic Climates

Four Seasons, One Portfolio

Dalio categorizes the economic environment into four basic “seasons”:

Rising Growth (Boom):

When the economy is booming, stocks shine. However, an over-reliance on equities can be risky if the bubble bursts. The All Weather Portfolio only assigns 30% to stocks, so you still get a slice of the boom without betting your house on it.Recession (Falling Growth):

During a recession, stocks tend to plummet. That’s when bonds—especially long-term treasuries—step in to cushion the blow. This portion of the portfolio is designed to rally when the economic outlook sours, helping to offset the losses in the equity slice.Inflation (Rising Prices):

Inflation can be a silent killer. When prices rise, the purchasing power of your money falls. This is where hard assets like gold and commodities come into play. They’re your insurance policy against inflation. When inflation spikes, these assets typically surge, preserving your real wealth. For a detailed discussion on how gold and commodities serve as inflation hedges, check out I Will Teach You To Be Rich.Deflation (Falling Prices):

In deflationary periods, cash and bonds become much more valuable as prices drop. The All Weather Portfolio’s bond-heavy approach shines here, ensuring that even if the economy is contracting, you’re not left in the lurch.

This balanced approach is why Dalio’s strategy is often hailed as one of the few portfolios that can truly handle any market condition. If you want to see some backtested performance data that puts these ideas to the test, take a look at the backtesting research on TradeQuantix and Curvo.

Real-World Performance: Weathering the Storms

How Does It Stack Up?

Let’s get real for a minute. No strategy is perfect, but the All Weather Portfolio has a track record that’s hard to ignore. Here’s a breakdown of how it has performed during some of the major economic events of the past few decades:

The 2008 Financial Crisis

During the global meltdown of 2008, most portfolios were bleeding red. The S&P 500 plunged about 37%, and even a standard 60/40 portfolio took a significant hit. In contrast, the All Weather Portfolio—thanks to its heavy allocation to treasuries—only dropped roughly 20% at its worst. That kind of drawdown is a godsend when you’re trying to sleep at night, knowing your nest egg isn’t evaporating.

The Dot-Com Bust (2000–2003)

When the tech bubble burst at the turn of the century, stocks took a nosedive, but long-term bonds rallied like nobody’s business. The All Weather Portfolio, with its balanced mix, would have softened the blow compared to an all-stock strategy. It’s the classic case of not putting all your eggs in one basket.

The COVID-19 Crash (2020)

Remember March 2020? Stocks tanked in a matter of days. While pure equity portfolios saw steep declines, the All Weather strategy—with its safety net of bonds—only suffered a 10–12% drop. And when the market rebounded, the recovery was quicker, all thanks to that well-chosen mix of assets.

Recent High Inflation (2021–2022)

Inflation spiked, interest rates soared, and conventional portfolios struggled. The All Weather Portfolio wasn’t immune—its bonds took a hit as yields spiked—but its dedicated hard asset slice (gold and commodities) helped cushion the fall. Sure, it wasn’t a silver bullet in 2022, but it still outperformed many strategies that weren’t built for such extreme conditions.

For more detailed backtesting and performance metrics, you can refer to resources like Optimized Portfolio and Retire Certain.

Why Should the Everyday Investor Care?

It’s Not Just for the Institutional Elite

Let’s cut through the Wall Street nonsense. You might be thinking, “Ray Dalio and Bridgewater Associates? That’s for the big dogs!” But here’s the truth: the ideas behind the All Weather Portfolio are simple enough for any savvy investor. In fact, Dalio himself shared a simplified version during his interview with Tony Robbins so that everyday investors could benefit from his insights.

The beauty of this portfolio is its simplicity and effectiveness. You don’t need a finance degree to understand it. It’s about having a mix of stocks for growth, bonds for safety, and hard assets for inflation protection. And if you’re the kind of investor who gets rattled every time the market dips, this strategy is designed to let you sleep better at night.

Take a moment to think:

Do you want to chase high returns only to suffer massive losses during a crash?

Or do you prefer a strategy that gives you steady, reliable returns—even if it means sacrificing a bit of the wild upside?

If you’re ready to embrace a more resilient approach, the All Weather Portfolio might be just what you need. It’s like owning a car that can handle any terrain—whether it’s smooth highways or rough country roads. For more on this simplified version of the portfolio, check out I Will Teach You To Be Rich.

How It Compares to the Traditional 60/40 Portfolio

The Mainstream vs. The Savvy Alternative

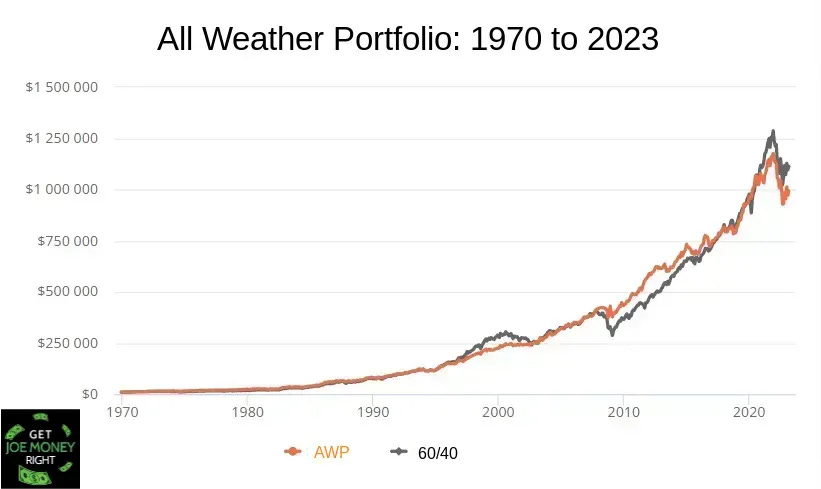

Most investors have heard of the good old 60/40 portfolio—60% stocks, 40% bonds. It’s been the go-to advice for decades. But here’s the catch: even a 60/40 split puts too much risk on the stock side. When stocks tank, they tend to tank hard, and the 40% in bonds isn’t always enough to cover the losses.

Here’s how the two stack up:

Risk Distribution:

60/40 Portfolio: Over 60% of your returns (and your risk) comes from stocks.

All Weather Portfolio: Only 30% is in stocks. The rest is a mix of bonds, gold, and commodities that spread the risk more evenly.

The result? The All Weather strategy has smaller drawdowns during crises. It’s not about chasing the highest return—it’s about managing risk so that no single market shock can ruin your portfolio.

Performance in Different Environments:

In a booming market: A 60/40 might outperform All Weather because of its higher stock exposure. But let’s be honest—no one likes riding a rollercoaster of ups and downs. Speaking of ups and downs, variance drain will eat your returns alive if you’re not careful. It’s not the average that gets you—it’s the rollercoaster.

In a downturn or high inflation scenario: The All Weather Portfolio shines, cushioning the blow with its heavy bond allocation and inflation hedges.

Simply put, if you want consistent, less volatile performance, the All Weather strategy gives you a smoother ride. For more backtesting comparisons, visit TradeQuantix.

Risk-Adjusted Returns:

The key measure here is the Sharpe ratio—a way of looking at return per unit of risk. Even if a 60/40 portfolio produces a slightly higher raw return in a bull market, its risk-adjusted returns often lag behind those of the All Weather Portfolio. That’s because All Weather’s downside protection means you’re not left crying over your investments during a market storm. Optimized Portfolio breaks down these metrics in detail.Practical Implementation:

Both strategies are easy to execute with ETFs, but All Weather requires you to handle five different asset classes instead of two. That said, modern tools and robo-advisors make rebalancing a breeze, so you don’t have to worry about micromanaging your investments.

In short, while the 60/40 portfolio might seem attractive when everything’s going up, it can turn into a nightmare when the market crashes. The All Weather Portfolio is built to protect you on the worst days, even if it means missing out on a bit of the wild upside.

The Investment Secret Most Investors Are Overlooking

Think Differently, Act Differently

Let’s be blunt. Vanilla investors—the ones who follow mainstream advice without question—often end up with portfolios that can’t handle a real economic storm. They get lured by the promise of high returns from equities and then get hit hard when the market takes a downturn. Meanwhile, savvy investors know that it’s not about predicting the future; it’s about preparing for every eventuality.

Ray Dalio’s approach is refreshingly contrarian. He doesn’t bet on one outcome. Instead, he builds a portfolio that sees all the risks coming and is prepared for each one. When everyone else is chasing after the next big stock, the smart money is already sitting on a diversified mix that can weather the storm. As one article on Tony Robbins’ blog puts it, “when the going gets tough, the tough get diversified.”

This isn’t just academic theory—it’s a strategy that has been battle-tested through multiple crises, from the dot-com bust to the 2008 meltdown and even the COVID-19 crash. And while the average investor might be tempted to follow the crowd, the truth is that following the crowd rarely leads to superior returns. If you’re ready to challenge conventional wisdom and take control of your financial destiny, the All Weather Portfolio offers a blueprint for doing just that.

Practical Steps to Implement the All Weather Portfolio

For the Everyday Investor

Alright, let’s get down to brass tacks. Here’s how you, the everyday investor, can put the All Weather strategy to work for you:

Open a Brokerage Account:

If you haven’t already, sign up with a low-cost brokerage that offers commission-free ETF trades. This is your first step toward building a diversified portfolio without excessive fees.Set Up Your Asset Allocation:

Use the breakdown we discussed above:Automate Your Investments:

Set up automatic contributions and periodic rebalancing. You can use robo-advisors or set calendar reminders to review your portfolio quarterly. Rebalancing is key—over time, one asset class will outperform, and your risk balance will shift. Don’t let it drift.Monitor, Don’t Micromanage:

The beauty of the All Weather approach is that it’s designed to be long-term and low-maintenance. Once you’re set up, trust the process. Markets will fluctuate, but your portfolio is built to withstand the ups and downs.Educate Yourself Continuously:

Stay informed about market conditions and economic cycles. But remember: don’t get distracted by every short-term headline. Resources like Of Dollars and Data and Papers with Backtest are great for deep dives into the strategy, while more mainstream sites might not offer the same depth of analysis.Be Patient and Confident:

This is not a get-rich-quick strategy. It’s about capital preservation and steady growth. As Ray Dalio famously said, “Don’t confuse return with performance.” It’s not about chasing the highest numbers in a bull market—it’s about avoiding the big losses when things go south.

By following these steps, you’re not just copying a strategy; you’re embracing a philosophy that smart investors have used for decades to thrive no matter what the economy does.

Final Thoughts: Why You Should Rethink Your Portfolio

Your Call to Financial Empowerment

Let’s wrap this up with a reality check. The mainstream narrative pushes you to follow the herd—pile into high-growth stocks and hope for the best. But if you’ve been paying attention, you know that when the market crashes, those strategies leave you with massive losses and sleepless nights.

Ray Dalio’s All Weather Portfolio is a wake-up call for every investor tired of playing the guessing game with the economy. It’s not about predicting the future; it’s about being prepared for every possible outcome. In a world where economic shocks are the norm rather than the exception, having a portfolio that’s built to weather the storm isn’t just smart—it’s essential.

If you're looking to step away from the typical approach and embrace a smarter way of investing, this strategy provides a powerful alternative. It's about investing thoughtfully—balancing risk, steering clear of major setbacks, and steadily building wealth over the long term.

Don’t be the investor who panics at every market dip. Be the one who says, “I’ve got this,” because your portfolio is built to handle whatever comes next. As you continue on your investing journey, remember that the window for building a resilient, diversified portfolio is always open—if you’re smart enough to seize the opportunity.

Now is the time to rethink your approach, challenge conventional wisdom, and build a portfolio that can truly stand up to any economic weather. If you’re ready to take that step, start by exploring the resources mentioned above, and consider how the All Weather strategy might fit into your long-term plan.

For more practical insights and smart investing strategies, stay tuned. While mainstream investors react and panic during market swings, informed investors focus on building resilient, diversified portfolios—possibly the smartest move you'll ever make.

Resources and Further Reading

If you want to dig even deeper into the All Weather Portfolio and understand the data behind the strategy, check out these must-read resources:

Ray Dalio’s All Weather Portfolio Explained – Of Dollars and Data

A Detailed Look at Ray Dalio’s All Weather Strategy – Papers With Backtest

Understanding the All Weather Portfolio – I Will Teach You To Be Rich

In Conclusion

If you’re an investor who’s had enough of watching your portfolio do somersaults every time the market hiccups, it’s time to consider an approach that’s built for every economic season. The All Weather Portfolio is about staying the course and building wealth over the long haul without being at the mercy of unpredictable market swings. It’s not the flashiest or the fastest route to riches, but it’s the one that smart money uses when it matters most.

While mainstream investors often chase after trends, choosing a diversified and balanced approach can provide a steadier and more reliable path to long-term success. Don't overlook the power of investing with a plan that's ready for anything—because when market conditions shift, you'll be thankful you did.

Now go ahead and take control of your financial future. Seize the opportunity, challenge the conventional, and build a portfolio that’s as resilient as you are. After all, being prepared for any weather isn’t just smart—it’s essential.

Happy investing, and may your portfolio weather every storm!

Want more insights like this delivered straight to your inbox? Subscribe to Get Joe Money Right and never miss a post! Each week, I break down investing, wealth-building, and financial strategies in a way that makes sense for everyday people like you and me. The smart money moves fast—make sure you're staying ahead of the game.

Disclaimer: This post is for educational purposes only and does not constitute financial advice. Always do your own research or consult a professional advisor before making investment decisions.