Charlie Munger once said: “If all you ever did was buy high-quality stocks on the 200-week moving average, you would beat the S&P 500 by a large margin over time. The problem is that few human beings have that kind of discipline.”

Investors have long marveled at the consistent outperformance of index funds over many active managers. While indexing has become a popular strategy—research shows that over a 20‐year horizon, index funds often beat around 95% of active funds—there’s a compelling, alternative method that not only builds on diversification but also introduces a smart timing component. Inspired by the legendary insights of Charlie Munger and Warren Buffett, this strategy focuses on buying high‑quality stocks when their prices retreat to the 200‑week moving average.

The Wisdom of Investing Legends

Warren Buffett is celebrated as one of the greatest value investors of all time, yet much of his success is credited to his long‑standing partnership with Charlie Munger. Munger, known for his sharp wit, deep investment acumen, and timeless wisdom, famously suggested:

“If all you ever did was buy high‑quality stocks on the 200‑week moving average, you would beat the S&P 500 by a large margin over time.”

This statement encapsulates a philosophy that marries fundamental quality with a long‑term technical filter. While Buffett and Munger are renowned for their rigorous fundamental analysis, Munger’s perspective hints at an often‑overlooked edge: timing your investments by purchasing shares at a discount relative to their long‑term price trend.

Why Charlie Munger’s Advice Works

Buffett and Munger didn’t achieve their massive success through complicated schemes. Their genius lies in simplicity and consistency—focusing only on great companies and buying when prices dip. Munger’s strategy blends two key elements:

- Quality: Choosing excellent, financially strong companies.

- Timing: Buying shares only when they’re trading near their long-term price trend.

It’s about buying fantastic companies at fair prices, not just cheap stocks hoping for a quick buck.

Identifying Quality Stocks

At the core of this strategy lies the need to identify “quality stocks”—companies with enduring competitive advantages, robust profitability, and solid balance sheets. Characteristics of such stocks include:

- Durable Competitive Advantages: These are businesses that enjoy a market edge that is hard to replicate.

- Strong Profit Margins: High net income and free cash flow margins often point to operational excellence.

- Institutional Appeal: Stocks favored by institutional investors tend to show stability during volatile periods.

For instance, consider a company like Union Pacific Railroad, which boasts a unique market position, impressive profit margins, and plays a critical role in North America’s logistics network. Although not every exemplary business fits every investor’s valuation criteria, the underlying principle is to seek out companies that generate consistent, long‑term value. For more on what constitutes a quality company, check out this comprehensive guide on quality investing or Ray Dalio’s All Weather Portfolio for maximum diversification.

What Is the 200-Week Moving Average?

The 200‑week moving average is a technical indicator that smooths out price data over nearly four years, helping investors understand the long‑term trend of a stock. By waiting to purchase quality stocks until they retreat to this average, investors can potentially secure a better entry point—buying a fundamentally strong asset at a price that reflects a temporary dip rather than its peak value. This method acts as a disciplined filter:

- Prevents Overpaying: Purchasing at or near the 200‑week average ensures you’re not buying at a historical high.

- Rewards Patience: The strategy is predicated on the idea that great companies will eventually rebound, rewarding those who buy in during market corrections.

For an in‑depth look at how moving averages work in technical analysis, see this Investopedia article on moving averages.

Real-Life Examples: Stocks That Delivered Big Gains

Several blue‑chip stocks have demonstrated the potential benefits of this approach. Here’s how some industry leaders have interacted with their 200‑week moving averages:

- Apple (AAPL): Over decades, Apple has maintained its market leadership. Despite occasional tests of its 200‑week average, the company’s strong fundamentals have kept it on an upward trajectory.

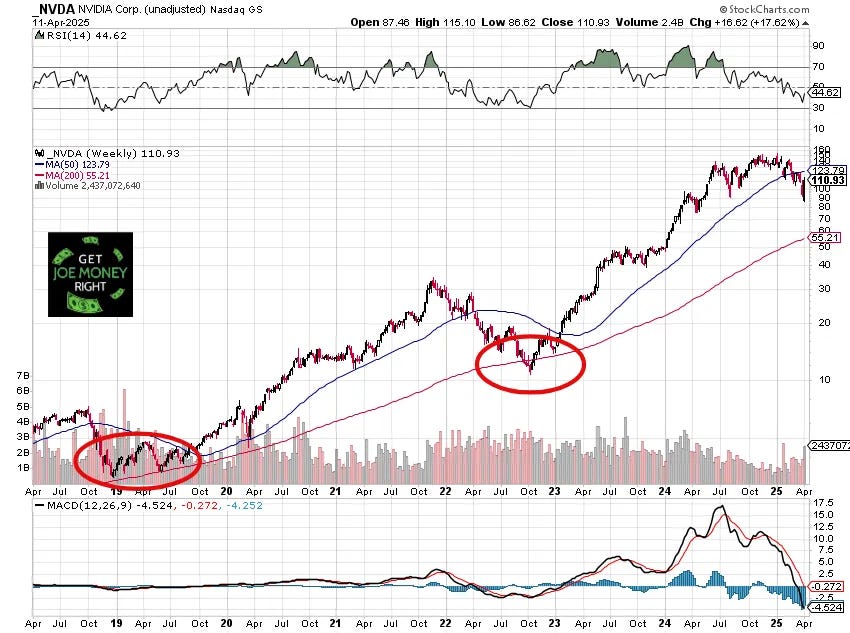

- Nvidia (NVDA): Once hit hard during the tech downturn in 2022, Nvidia’s retreat to its 200‑week average signaled a potential buying opportunity, leading to impressive gains as the semiconductor boom resumed.

- Microsoft (MSFT): Following a period of stagnation, Microsoft’s pullback to its 200‑week average in late 2022 provided investors a chance to participate in its subsequent rally.

- MicroStrategy (MSTR): As a proxy for Bitcoin exposure, MicroStrategy’s dip to its 200‑week average proved to be a powerful contrarian signal for patient investors.

- Advanced Micro Devices (AMD): Recently, AMD’s return to its 200‑week moving average has attracted attention from contrarian investors seeking long‑term asymmetric opportunities.

These examples illustrate that even during market downturns, a disciplined approach to buying quality stocks at attractive price levels can create significant upside over time.

Combining Fundamentals and Technicals for Max Gains

The brilliance of this strategy lies in its dual focus. While fundamental analysis ensures you’re selecting companies with solid financials and enduring competitive advantages, the 200‑week moving average acts as a gatekeeper, ensuring you’re not overpaying for these assets. It’s a reminder that even the best companies can be purchased at a discount if you wait for the right moment.

However, like any investment approach, this strategy requires diligent research and a long‑term perspective. Market dynamics can shift, and while the 200‑week moving average is a powerful tool, it’s not infallible. For further insights into combining technical analysis with long‑term value investing, you might explore additional resources on value investing principles and technical analysis basics.

Bottom Line: Turn Patience into Profit

Charlie Munger’s timeless insight challenges investors to rethink the traditional approach of buying stocks based solely on valuations or market sentiment. By focusing on quality stocks and waiting for them to trade at or near their 200‑week moving average, investors can potentially secure superior returns over time. This blend of rigorous fundamental analysis and long‑term technical timing not only honors the legacy of investing legends like Buffett and Munger but also offers a pragmatic pathway for those seeking to outperform the broader market. By buying quality stocks when they touch their 200-week moving average, you position yourself for sustainable long-term gains and outperformance of the broader market.

Make sure to do your homework, understand your risk tolerance, and combine this strategy with a diversified investment approach. Stay smart, disciplined, and patient, and you’ll find that outperforming Wall Street isn’t reserved just for the pros.

Happy investing!

Disclaimer: This post is for educational purposes only and does not constitute financial advice. Always do your own research or consult a professional advisor before making investment decisions.