Introduction

There are many loan options available in modern finance, which can be overwhelming. There is one structure that stands out for its simplicity and cash flow appeal: the straight loan. But what is a straight loan, and why do savvy investors and strategic borrowers prefer it?

Straight loans, also called interest-only loans or bullet loans, require only interest payments until the full loan balance is repaid at maturity. A structured loan like this might sound unconventional, but it’s a tried-and-true option for borrowers who want flexibility and affordability in the short term over long-term repayment.

We’ll examine the mechanics, advantages, drawbacks, and real-world applications of straight loans in this article. Whether you’re considering this route for a real estate investment, a business bridge loan, or simply expanding your financial literacy, understanding how straight loans function could be your key to more effective money management.

Understanding the Straight Loan Structure

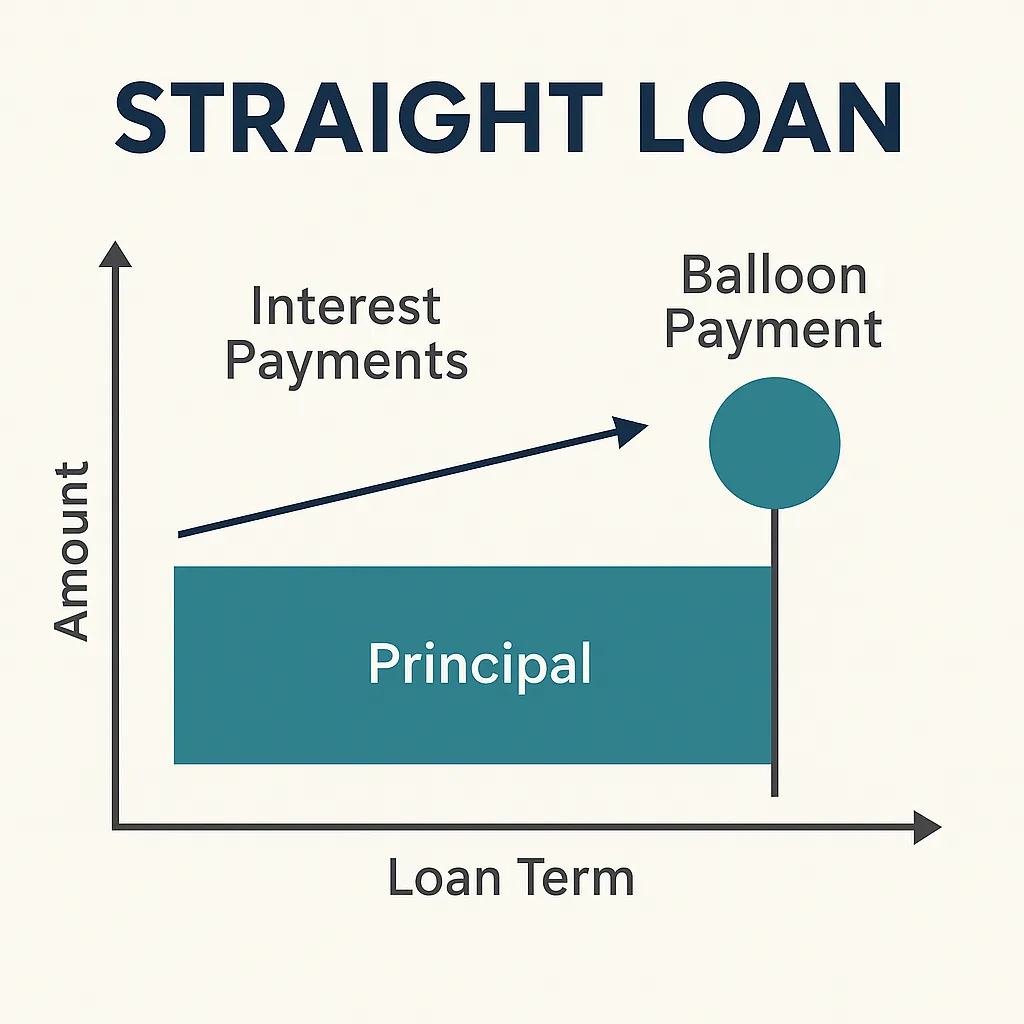

Straight loans, often referred to as interest-only loans or bullet loans, represent one of the simplest yet most misunderstood financial tools in the lending world. At their core, straight loans allow borrowers to make only interest payments throughout the term of the loan. The entire principal is paid back in one single balloon payment at the end of the term.

For instance, consider a $100,000 straight loan with a fixed 6% interest rate for five years. Each month, the borrower pays $500 in interest (6% annually, divided over 12 months), and at the end of five years, they pay the entire $100,000 principal in a single lump sum. The periodic payments remain low and predictable, which is one of the most appealing features of this loan type.

This simplicity is what earned it the nickname “straight”—it has a straightforward payment structure without the complications of gradual principal reduction or fluctuating payment schedules.

How Interest-Only Repayment Works

Straight loans are often chosen for their interest-only repayment structure. This setup is highly attractive in situations where preserving cash flow is critical, such as during the early stages of a real estate investment or when income is expected to rise in the near future.

There are typically two models within interest-only structures:

- Periodic Interest Payments: The borrower pays interest on a monthly or quarterly basis while deferring the principal until maturity.

- Accrued Interest Model: In rare cases, interest may also be deferred, causing both the principal and accumulated interest to be due at the end. This variant increases the borrower’s final payment but offers maximum payment deferral during the loan’s life.

Because there’s no reduction in the principal over the loan term, the total amount of interest paid over time can be higher than with an amortizing loan. However, the benefit lies in keeping payments low when liquidity matters most.

This type of loan is especially common in commercial real estate, bridge financing, and specific types of corporate debt instruments, such as bullet bonds.

Next, let’s visualize how this repayment model works.

Straight Loans vs. Traditional Loan Types

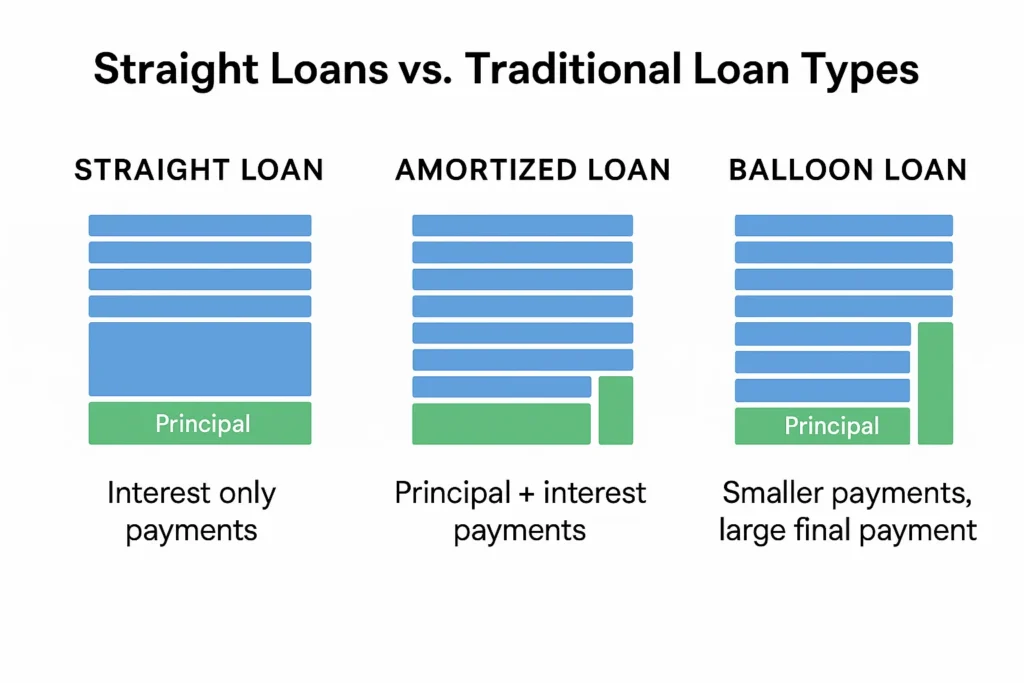

When evaluating any financing option, it’s crucial to understand how it compares with alternatives. Straight loans differ significantly from the two most common loan structures: amortized loans and balloon loans. Each serves a different financial strategy, and recognizing the contrasts can help borrowers make smarter decisions aligned with their needs.

Comparing with Amortized and Balloon Loans

At first glance, straight loans and amortized loans seem like two sides of a coin. In an amortized loan, each payment contributes to both interest and the principal, gradually reducing the debt until it’s fully paid off by the end of the term. Home mortgages, car loans, and personal installment loans typically follow this model.

In contrast, a straight loan keeps the principal intact for the entire duration. Payments only cover interest until the loan matures, at which point the full principal must be paid in one large sum, known as a balloon payment.

This characteristic technically makes every straight loan a type of balloon loan, but not all balloon loans are straight loans. Balloon loans may be partially amortized—meaning some principal is repaid along the way—while straight loans are strictly interest-only until the final due date.

Let’s use a simple example. Imagine two borrowers take out $100,000 loans for 5 years at 5% interest:

- Borrower A has an amortized loan and pays ~$1,887/month (both principal and interest).

- Borrower B has a straight loan and pays $417/month in interest only, then repays the $100,000 principal in one payment at year five.

Borrower B enjoys lower monthly payments but faces a massive final obligation. Borrower A pays more each month but avoids the stress of a balloon payoff.

Monthly Payments and Payoff Timelines

This fundamental difference in structure dramatically affects cash flow, long-term planning, and total interest paid. Here’s how:

| Loan Type | Monthly Payment | Principal Payoff | Equity Built |

|---|---|---|---|

| Straight Loan | Interest only ($417) | Entire balance due at end ($100,000) | None until maturity |

| Amortized Loan | Higher ($1,887) | Gradually paid over time | Grows monthly |

| Balloon Loan | Varies (partial amort.) | Remaining balance due at end | Some equity built |

While straight loans offer relief on recurring payments, they don’t reduce the total balance owed. As a result, borrowers must plan ahead to refinance, sell the asset, or have cash available when the term ends.

In practice, amortized loans are better for long-term ownership and financial security, while straight loans are optimal when short-term liquidity or investment leverage is the priority.

Real-World Uses and Applications of Straight Loans

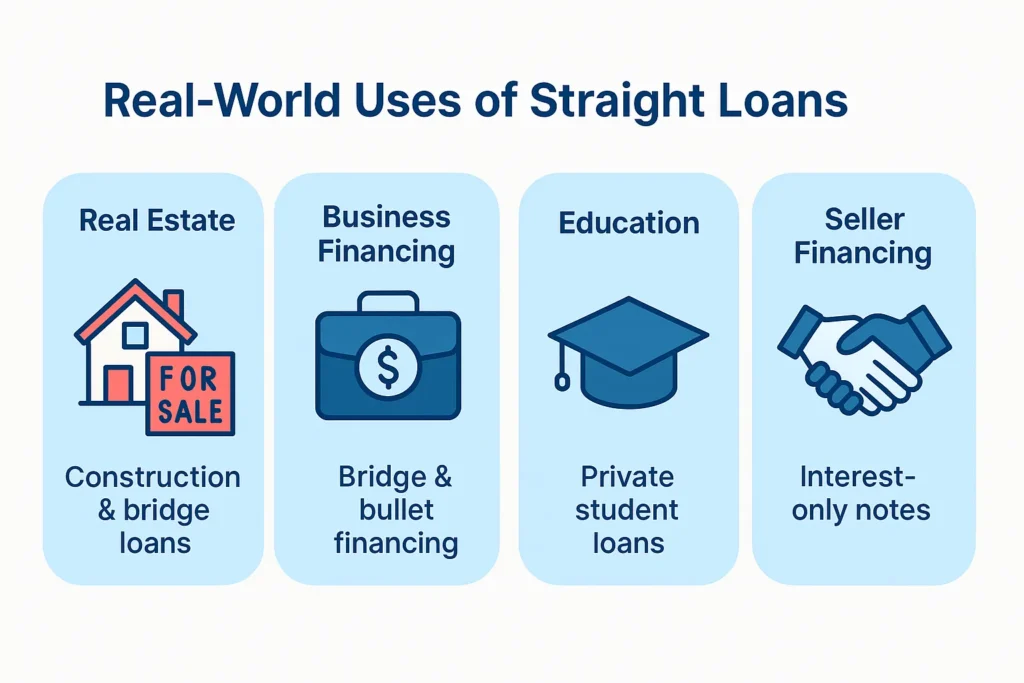

While straight loans might seem like a financial relic to the average borrower, they’re actually alive and well in several modern financial niches. Their flexibility and lower interim payment structure make them highly valuable in specific scenarios across real estate, business finance, and personal borrowing.

Usage in Real Estate, Business, and Personal Finance

1. Real Estate and Property Investment

Straight loans are a common feature in real estate development and investment—especially when time, cash flow, and exit strategies are central. For example:

- Construction Loans: Real estate developers frequently use straight loans during construction phases. Because the property isn’t producing income during this time, paying only interest makes financial sense. Once the project is completed and leased or sold, the principal is paid off.

- Bridge Loans: Investors or homebuyers waiting on a sale may use a short-term straight loan to cover costs while transitioning from one property to another.

- House Flippers: These borrowers capitalize on low interim payments to keep costs down while renovating and preparing a property for sale.

2. Business and Corporate Finance

Businesses leverage straight loans for working capital, inventory financing, and strategic investments:

- Bridge Financing: A business anticipating a future cash influx (like customer payments or asset liquidation) may use a short-term straight loan to maintain operations.

- Bullet Bonds: In the bond market, many corporate bonds operate on the same principle as straight loans—interest-only payments during the term and principal due at maturity.

- Startup or Expansion Funding: Some businesses seek straight loans to manage early-stage growth without straining cash flow, planning to refinance or pay the principal later.

3. Personal Finance & Education

In personal lending, straight loans appear more rarely but still serve a purpose in specific contexts:

- Interest-Only Mortgages: These allow homeowners to pay only interest for a set period, ideal for those who anticipate higher income or plan to sell the property soon.

- Private Student Loans: Some educational financing plans include interest-only periods while the borrower is in school, mimicking a straight loan structure before full amortization begins post-graduation.

- Seller Financing: In private real estate deals, a seller may carry an interest-only note from the buyer, offering low initial payments and full payoff later.

Common Borrower Profiles and Motivations

Understanding who uses straight loans helps clarify why they remain relevant despite their risks:

| Borrower Type | Motivation for Choosing a Straight Loan |

|---|---|

| Real Estate Developer | Minimize payments during construction or property lease-up |

| Investor/House Flipper | Keep costs low during short-term property holds |

| Business Owner | Manage short-term liquidity until revenue or investment returns come in |

| Wealthy Individual | Preserve capital or leverage interest-only jumbo mortgages |

| Student Borrower | Defer principal during education, with intent to pay later |

Straight loans give these borrowers control over cash flow, allowing them to match repayment schedules with income expectations, investment returns, or asset sales. They’re not one-size-fits-all, but in the right hands, they’re a powerful tool.

Risks, Regulations, and Considerations

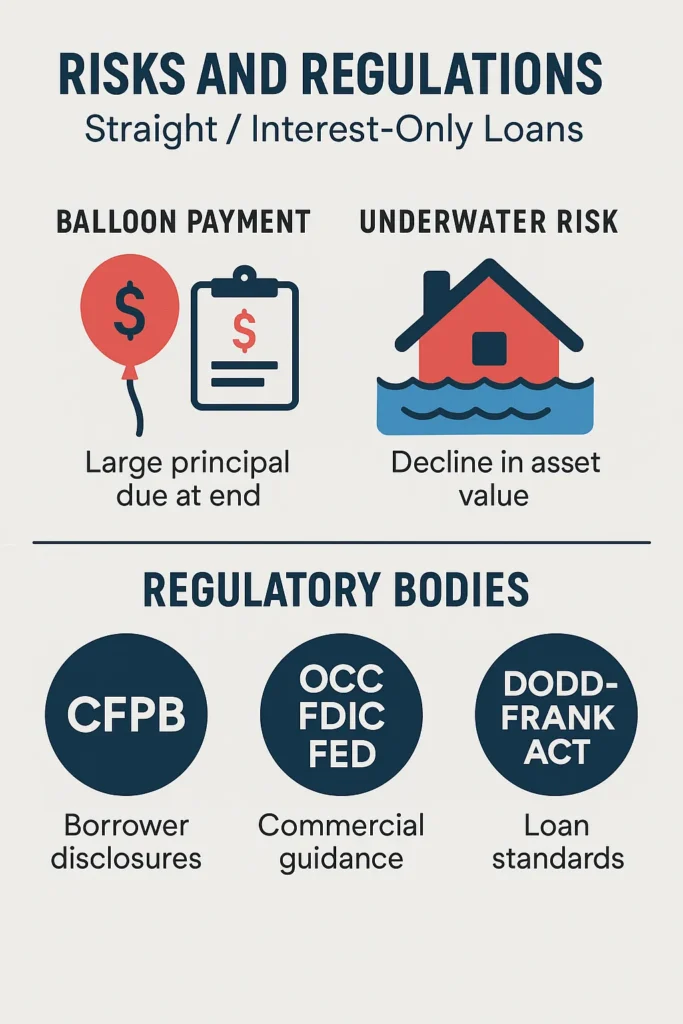

While straight loans offer flexibility and strategic advantages, they also come with serious caveats. From looming balloon payments to regulatory hurdles, borrowers and lenders must be fully aware of the risks and rules that govern this unique loan type.

Balloon Payment and Refinancing Risks

The most significant risk in any straight loan is the balloon payment—the large, lump-sum principal repayment due at the end of the term. If the borrower hasn’t prepared financially or secured a refinancing plan, this single payment can be overwhelming.

Many borrowers assume they’ll simply refinance when the loan matures. But here’s the danger: what if refinancing isn’t an option? Market conditions may shift, interest rates may rise, or the borrower’s credit situation may deteriorate. These variables can leave someone in a tough spot, especially if they relied on optimistic future scenarios.

Let’s consider a real-world example. During the 2008 housing crisis, thousands of homeowners with interest-only or balloon mortgages faced massive payment shocks. Property values plummeted, refinancing dried up, and many couldn’t afford their balloon payments—leading to widespread defaults and foreclosures.

Straight loans also do not build equity. Because the borrower never pays down the principal during the loan term, any drop in the asset’s value (like a home or commercial building) means the borrower could become “underwater”—owing more than the property is worth.

Lastly, the total interest cost over time may be higher. With the entire principal outstanding for the duration, the borrower pays interest on the full amount, not on a declining balance. Over a 5-year term, this difference adds up.

U.S. Legal and Regulatory Environment

After the financial meltdown of the late 2000s, regulators took a long hard look at nontraditional lending products like straight loans. The result? Tighter oversight and new rules—especially in the consumer mortgage space.

Key regulations affecting straight loans include:

- Ability-to-Repay (ATR) Rule: Lenders must verify that the borrower can repay not just the initial interest-only payments, but the full amortized payment once the interest-only period ends.

- Qualified Mortgage (QM) Standards: Most interest-only and balloon-payment loans do not qualify as QMs under the Dodd-Frank Act, limiting their availability from traditional banks and lenders.

- Consumer Financial Protection Bureau (CFPB): Emphasizes transparency, requiring lenders to disclose balloon features clearly in the Loan Estimate and Closing Disclosure documents.

- Truth in Lending Act (TILA): Triggers additional disclosure requirements for loans with nonstandard features such as deferred principal.

In practice, most conventional, FHA, VA, and USDA mortgage programs no longer permit straight or interest-only structures. These loans are now largely confined to portfolio lenders, private banks, or niche commercial use cases.

| Regulatory Body | Impact on Straight Loans |

|---|---|

| CFPB | Enforces clear borrower disclosures and ATR compliance |

| OCC / FDIC / Federal Reserve | Issue guidance for safe use in commercial lending |

| Dodd-Frank Act | Limits straight loans from being classified as “qualified” |

These regulatory shifts aim to protect consumers from the pitfalls of unsustainable borrowing. However, for well-informed and well-resourced borrowers, straight loans remain an effective tool—just one that requires precise planning and backup strategies.

Is a Straight Loan Right for You?

Choosing the right loan structure isn’t just about numbers—it’s about aligning financial strategy, goals, and risk tolerance. Straight loans offer clear benefits, but they’re not for everyone. Understanding when and why they work best is essential to making a confident, informed decision.

Advantages for Cash Flow and Investment Strategy

One of the most attractive features of straight loans is cash flow flexibility. Because borrowers only pay interest during the term, their monthly obligations are substantially lower. This can free up capital for other purposes—whether that’s investing in property upgrades, funding business operations, or simply improving liquidity.

For investors, this can translate into higher cash-on-cash returns. Instead of tying up funds in loan principal repayments, the capital can be reinvested in ventures that yield better returns than the interest cost. For example:

- A property investor might use interest-only financing to maintain a positive rental income stream while waiting for property appreciation.

- A business might fund expansion or equipment purchases while deferring large payments until revenue scales up.

- A homeowner expecting a bonus or inheritance might use a straight loan to temporarily keep mortgage payments low.

Straight loans also enable borrowers to qualify for larger loan amounts based on payment-to-income ratios, since the required monthly payments are smaller. This makes them appealing to high net worth individuals, real estate investors, and business owners with fluctuating income streams.

When to Avoid and Alternatives

Despite their appeal, straight loans aren’t suitable for every financial profile. You should avoid them—or proceed with extreme caution—if:

- You lack a clear exit strategy (refinancing, asset sale, or savings) for the balloon payment.

- Your income is unpredictable or declining, reducing your ability to manage future obligations.

- You’re a first-time homebuyer or someone unfamiliar with risk-based financial planning.

- You’re relying on asset appreciation (e.g., property value) to bail you out at the end of the loan.

In these situations, fully amortizing loans or partially amortized balloon loans offer a more secure alternative. They may come with higher monthly payments, but they build equity and reduce exposure to refinancing risk.

Another middle-ground option is the interest-only period mortgage. These loans start with interest-only payments (e.g., for 5–10 years) and then transition into full amortization. They offer initial payment relief but avoid the balloon risk of a full straight loan.

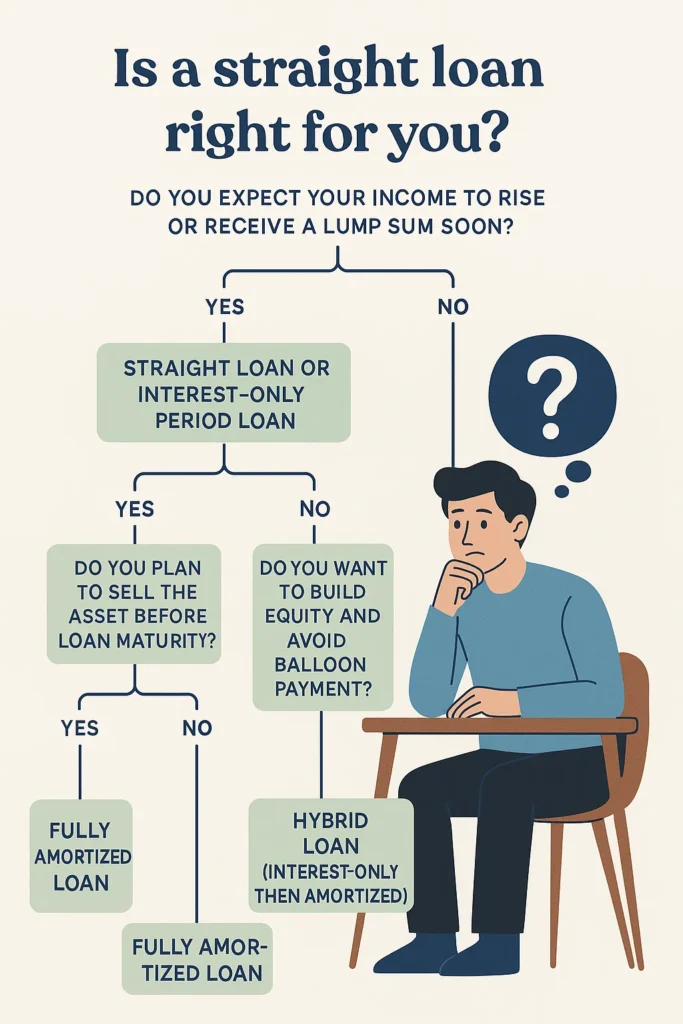

A Quick Decision Matrix

Here’s a summary to help assess your fit:

| If You… | Then Consider… |

|---|---|

| Expect income to rise or receive lump sum soon | Straight Loan or Interest-Only Period Loan |

| Plan to sell the asset before loan maturity | Straight Loan |

| Want to build equity and avoid balloon payment | Fully Amortized Loan |

| Have irregular income but long-term stability | Hybrid Loan (Interest-only then amortized) |

Ultimately, straight loans reward strategic thinking but punish complacency. Used wisely, they can be a powerful asset. Used carelessly, they can lead to financial pitfalls.

Conclusion

In the dynamic world of personal and commercial finance, straight loans stand out as both powerful and polarizing. Their simple structure—interest-only payments followed by a single balloon payment—makes them ideal for borrowers who prioritize short-term flexibility, strategic investment leverage, or temporary liquidity.

However, this simplicity belies the complexity of timing, planning, and risk involved. A straight loan isn’t just a shortcut to lower payments—it’s a tool that demands discipline, foresight, and a clear exit strategy. Used wisely, it can be an effective bridge to opportunity. Used carelessly, it can become a debt trap.

Before choosing a straight loan, assess your income projections, financial goals, and risk appetite. Always run scenarios, speak with a qualified financial advisor, and understand the full implications of deferring principal repayment. In some cases, alternatives like hybrid or amortized loans may provide greater peace of mind while still meeting your needs.

Ultimately, straight loans aren’t outdated—they’re specialized. For the right borrower, in the right situation, they offer a level of agility traditional loans can’t match.

Disclaimer: This post is for educational purposes only and is not financial, legal, or tax advice. Do your own research or consult a qualified professional before making any decisions.

Affiliate Disclosure: GetJoeMoneyRight.com is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com and affiliated sites.