Discover how to use box spreads in options trading to generate fixed returns, borrow at low interest rates, and earn T-bill-like yields—all with defined risk and zero directional exposure.

1. Why You’ve Never Heard of a Box Spread

Vanilla investors obsess over meme stocks and AI hype. Meanwhile, market makers quietly borrow millions at Treasury‑like rates by selling something called a box spread—then redeploy that cheap cash for higher returns.

If Wall Street elites are doing it, why hasn’t your broker pitched it to you? Simple:

- Most brokers make juicier margins by lending you money at 7–10 % than by letting you borrow at the sub‑5 % rate embedded in a box.

- A box spread needs four legs, so the jargon looks scary—until you see it’s just financial Lego.

- Education is thin. Until last year, the Options Industry Council’s box‑spread white paper gathered dust on page 99 of Google.

Today we fix that.

2. Box Spread 101 — A Plain‑English Definition

A box spread is a four‑option package that guarantees a fixed dollar payoff at expiration—no matter where the underlying trades.

That fixed payoff means you can lend money (long box) or borrow money (short box) at the interest rate implied by option prices. Think of it as a DIY zero‑coupon bond you assemble in your brokerage account.

3. The 4‑Leg Recipe: Building a Box Spread

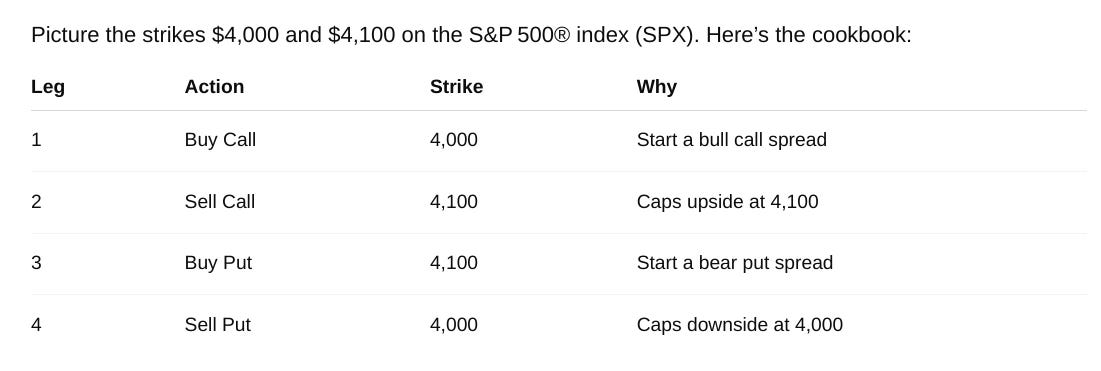

Picture the strikes $4,000 and $4,100 on the S&P 500® index (SPX). Here’s the cookbook:

Result: No matter where SPX settles, the net payout on expiry is always 100 points (≈ $10,000 per contract).

Because SPX options are European‑style (they cannot be exercised early), the payoff is locked.

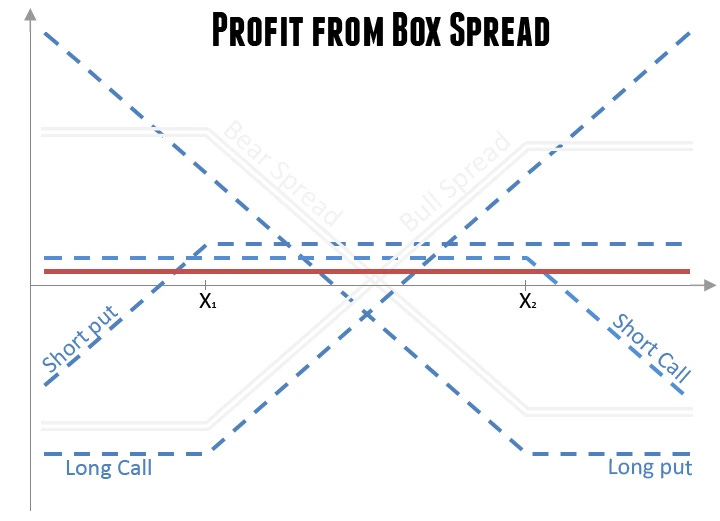

4. Box Spread Payoff Diagram

Long Box: You pay, say, $9,760 today and receive $10,000 at expiration—an implied 3 % return.

Short Box: You receive $9,760 today and owe $10,000 later—effectively borrowing at 3 %.

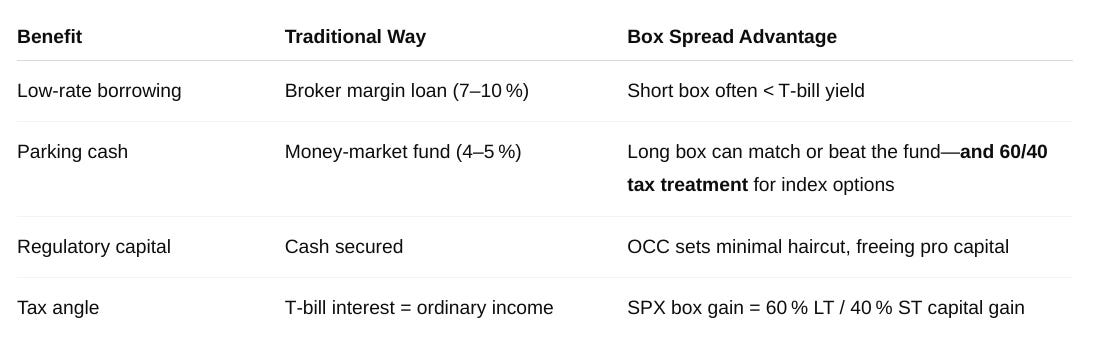

5. Why the Pros Love Boxes (and You Should Care)

Further Reading: Alpha Architect’s deep dive and Moontower Meta on the BOXX ETF reveal how hedge funds juice returns with boxes.

6. Real‑World Use Cases

6.1 Synthetic Lending for Savers

Long boxes let you stash idle cash at yields similar to short‑term Treasuries—sometimes a hair higher. EarlyRetirementNow crunches the math in this step‑by‑step case study.

6.2 Cheap Portfolio Leverage

Instead of paying your broker 9 % to buy more S&P 500, a short SPX box might cost 4–5 %. That spread can be the difference between “meh” and “Maui.”

6.3 Interest‑Rate Arbitrage

Market makers scalp pennies when a box’s implied rate drifts above or below Treasury bills. Their rapid fire trades keep option prices in line with put‑call parity.

6.4 Capital‑Structure Trades

Arb desks sometimes pair a long corporate bond with a short index box to isolate credit spread. Exotic? Yes. But now you know their secret sauce.

7. What Are The Risks Of A Box Spread?

Rule #1: A box spread is “risk‑free” only if you respect the fine print.

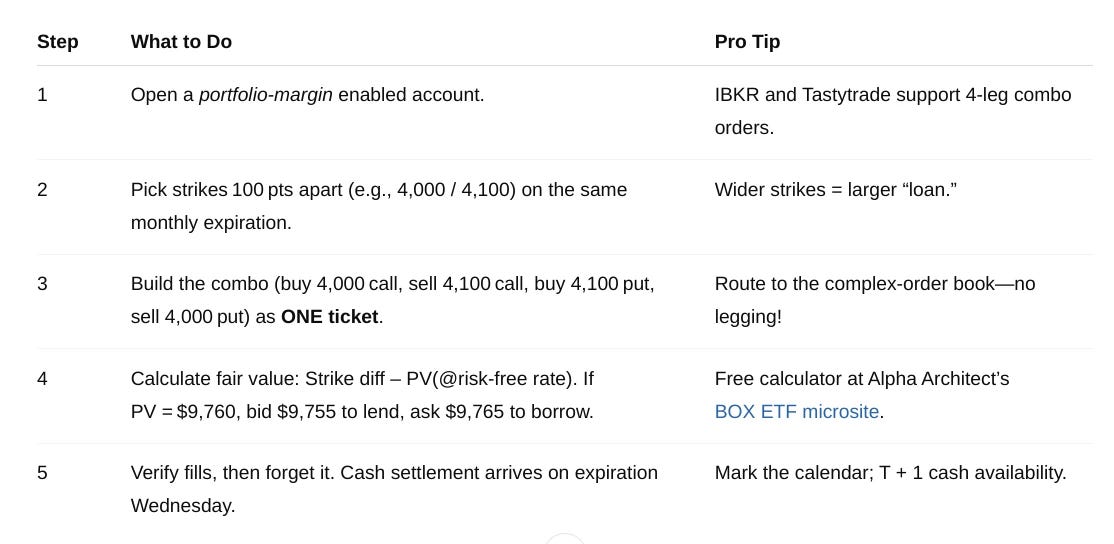

- Early Assignment – Use European‑style, cash‑settled index options (SPX, RUT, NDX). American stock options can nuke the box if someone exercises early for a dividend.

- Execution Slippage – Enter all four legs as one combo order. One mis‑fill can flip a sure thing into a live grenade.

- Transaction Costs – Four legs = four commissions. Size matters; sub‑$5k notional trades get eaten alive by fees.

- Margin Rules – A short box ties up capital unless you have portfolio margin. Check your broker’s small print.

- Tax Foot‑Faults – Short boxes create capital losses (you pay back more later). Losses offset capital gains, not salary. Plan ahead.

- Counterparty/Settlement – The OCC has a spotless record, but it’s not Uncle Sam. Slightly higher implied rates reflect that.

- Liquidity Droughts – In a crisis, bid‑ask spreads widen. Don’t count on exiting early at the mid.

8. Step‑by‑Step: Your First SPX Box Spread

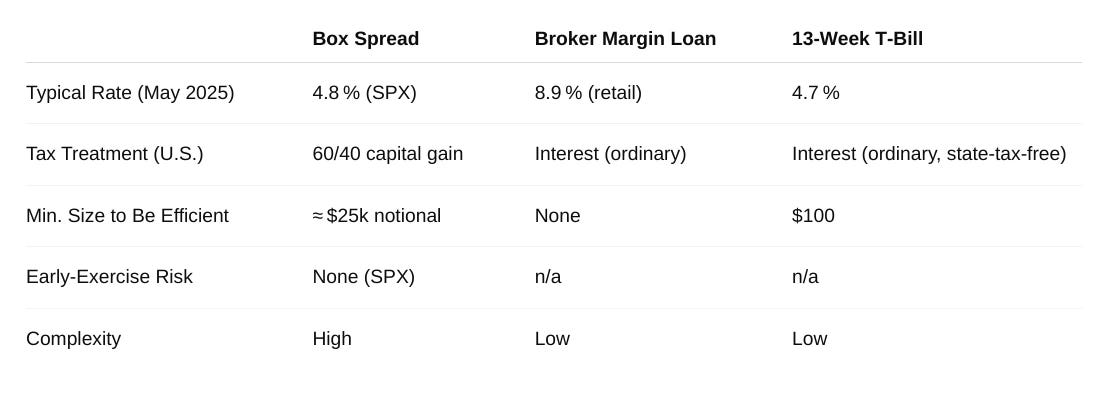

9. Box Spreads vs. Margin Loans vs. T‑Bills

10. Frequently Asked Questions

Is a box spread bullish or bearish?

Neither. It’s delta‑neutral; you’re trading interest rates, not stock direction.

Can I use box spreads inside an IRA?

Almost never. IRAs prohibit naked option shorts, which a short box technically contains.

Do I need to monitor it daily?

For European index boxes, weekly check‑ins are fine. Just confirm no leg is mis‑priced and margin is comfy.

What happens if rates move after I enter?

Your mark‑to‑market P&L will wiggle, but if you hold to expiration the fixed payoff is guaranteed.

11. Bottom Line & Next Steps

Savvy investors don’t overpay for money. A box spread lets you be the bank—either earning a T‑bill‑like yield on idle cash or borrowing below your broker’s sticker‑shock rates.

Ready to act?

- Bookmark the OIC white paper and run their rate table against your broker’s margin quote.

- Open a portfolio‑margin account if you don’t have one.

- Test‑drive a micro‑box on SPX or RUT—just one contract—to feel the mechanics.

- Subscribe to Get Joe Money Right (it’s free every Sunday) so you never miss contrarian tools the mainstream ignores.

The window for cheap leverage isn’t open forever. The next time Wall Street shifts rates, you’ll either complain or capitalize. Average Joes who act today know which camp they’ll be in.

Disclaimer: This post is for educational purposes only and is not financial, legal, or tax advice. Do your own research or consult a qualified professional before making any decisions.

Affiliate Disclosure: GetJoeMoneyRight.com is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com and affiliated sites.